1. The removal of the Covid-19 policy and measures to boost consumption means more market opportunities for African business

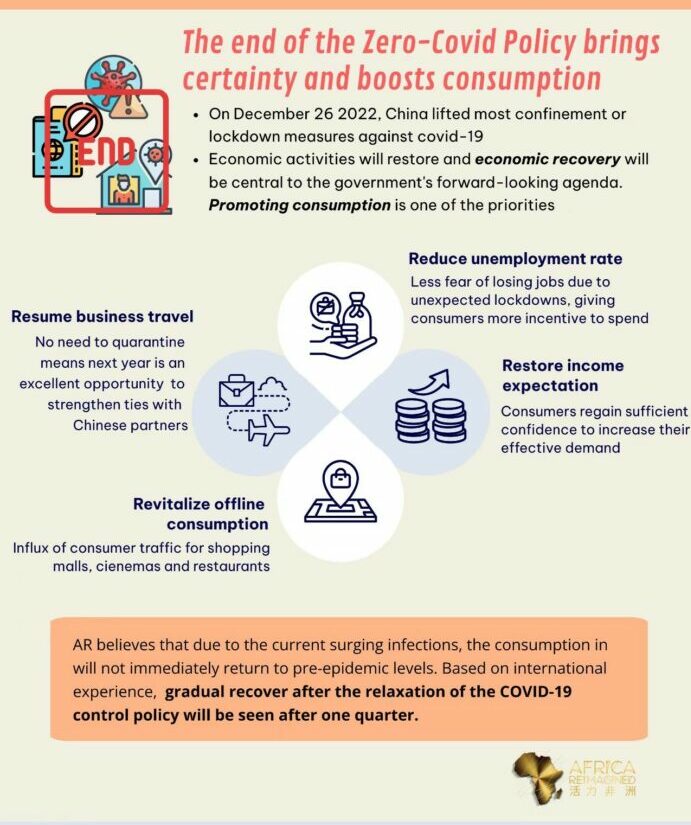

The Chinese government officially announced that it would downgrade its controversial “Zero-Covid Policy” on December 26, 2022. After waves of infections across the country due to the population’s lack of exposure to the virus, the first few weeks of 2023 have seen China returning to a level of pre-Covid normality with public spaces consistently opening up, and travel restrictions, testing, confinement and lockdown measures being lifted.

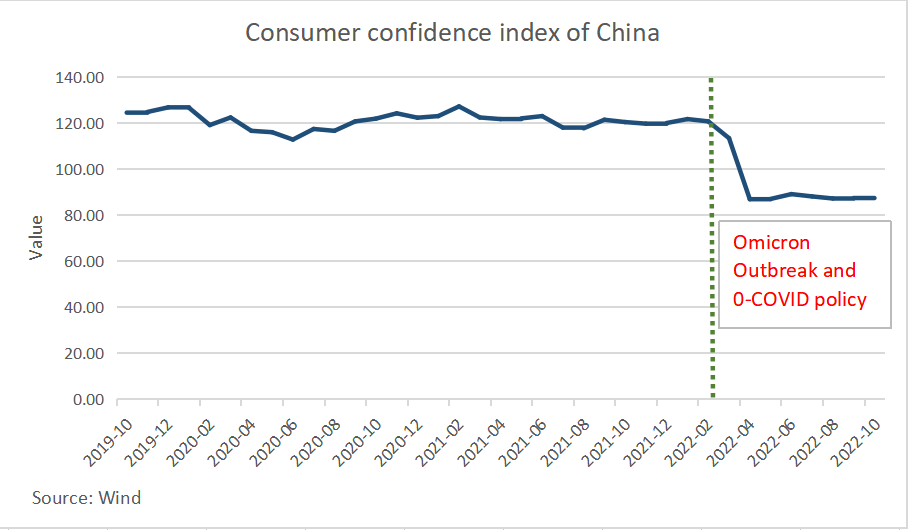

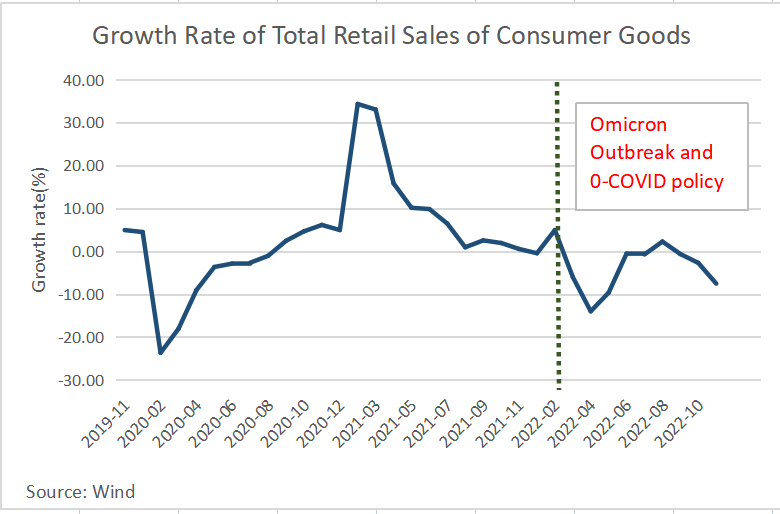

The most critical result of the end of the “Zero-Covid Policy” on consumption is bringing of certainty to consumers who no longer need to worry about losing their jobs due to unexpected city lockdowns. The data shows that repeated lockdowns and travel restrictions in 2022 dealt a huge blow to consumer confidence, which led to a continued decline in spending.

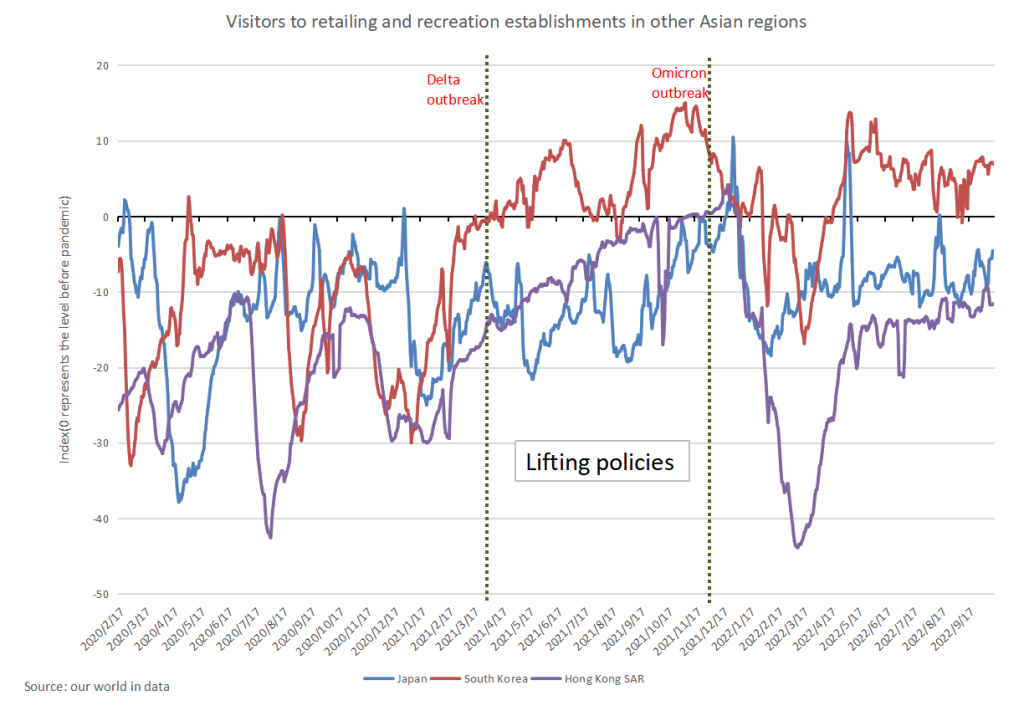

Africa Reimagined (AR) believes that due to the waves of infection and the need for China’s economy to recover, the population’s consumption of goods will not immediately return to pre-epidemic levels. According to international experience, the boost to consumption after the relaxation of the Covid-19 control policy will be seen after one quarter (consumption is still weak at the beginning of the relaxation due to the rise in cases). However, the end of the lockdown policy is expected to reduce the unemployment rate, which will boost consumer confidence and the willingness to consume will steadily increase. In addition, the Central Economic Work Conference, which is responsible for formulating work plans for the coming year, stated that promoting consumption will be a priority in 2023.

Under the combined influence of these factors, the Chinese market is showing a clear a recovery trend, which should be music to the ears of national and international business. In addition, the lifting of quarantine measures on arrival means that business travel will be more convenient, which will allow African companies to establish, resume or strengthen their ties with Chinese businesses. The elimination of lockdown and confinement measures also means that disruptions in Africa-China trade have also ceased and can allow African exporters to start taking full advantage of China’s market opportunities.

2. China’s e-commerce market is diversifying

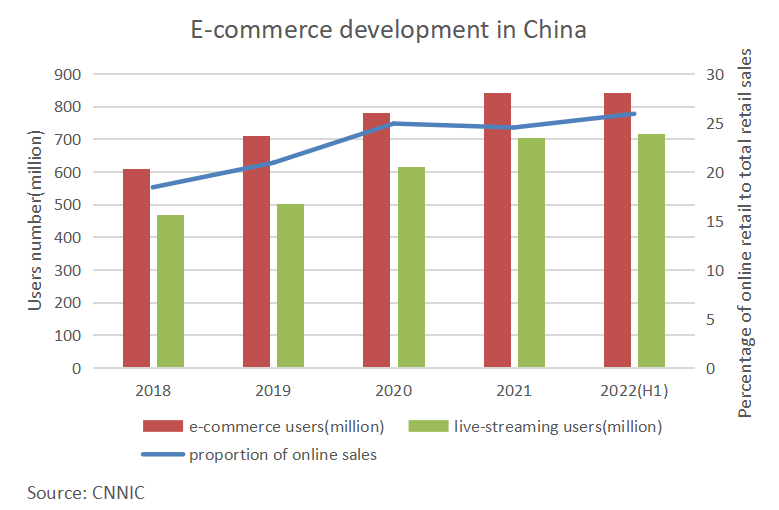

China’s e-commerce market has experienced rapid growth over the past few years, transfiguring into the largest e-commerce market in the world. Over the past year, however the share of online shopping in total retail sales has increased but at a slower pace, and the number of online shoppers has even decreased slightly, which means that China’s e-commerce penetration rate is close to saturation. The impact of COVID-19 on e-commerce is multifaceted. Firstly, consumers are more inclined to buy essential goods online due to city lockdowns and concerns about being infected. On the other hand, sales of major categories of online shopping, such as clothing, have declined due to reduced travel demand.

But simultaneously, China’s e-commerce market is also diversifying. Chinese consumers are shifting from the original major e-commerce giants – JD and Taobao – to WeChat stores and Douyin. Thus, with soon-to-rise consumer spending and a greater choice of e-commerce platforms to shop on, the China’s e-commerce market will no doubt rebound in 2023.

AR believes that in 2023, e-commerce remains a wise choice for African brands to enter the Chinese market, with its ability to help brands reach a large number of potential consumers at a lower cost. This year, African brands should consider exploring emerging e-commerce platforms and strategies such as social e-commerce and live streaming. Contact AR for advice and support on this.

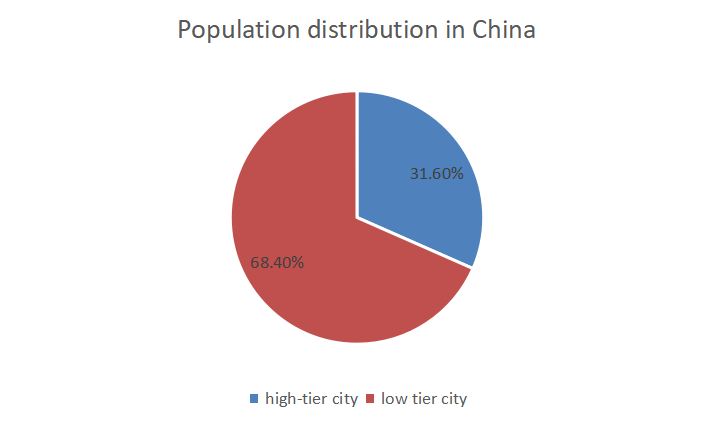

3. Consumer spending is growing and key market opportunities are emerging in lower-tier Chinese cities

“Low-tier cities” usually refers to cities with lower levels of economic development or smaller size, which have a huge consumer base. Their spending power is also growing significantly. According to a report by Minsheng Bank, in 2021, 19 of the 20 cities with the largest consumer expansion (including expansion of consumption, upgrading of consumption structure, and changes in consumption propensity) are low-tier cities. Low-tier cities also have well-educated consumers who are more interested in and willing to pay for trendy products. In addition, the willingness to purchase imported products is on the rise in low-tier cities. When shopping, low-tier city consumers are more discerning but have a stronger desire to shop. They tend to compare products before making decisions and pay more attention to quality.

AR believes that low-tier cities is a market worthy of attention by African brands and that consumers in low-tier cities are open and savvy to new products. Due to the limitations of offline consumption scenarios, consumers in low-tier cities are more likely to shop via e-commerce, especially through social e-commerce, which provides opportunities for emerging African brands. If the right partner can be found, direct access to the low-tier cities market through social commerce (group purchasing, WeChat shopping) may be a lucrative opportunity.

To learn more about how to take advantage of these trends, contact the Africa Reimagined team to receive a free consultation or learn more about our China market entry services here.

January 2023