How to ensure food security on the African continent is a major question for African policy makers, businesses and the international community. A recent report by Mckinsey highlighted that 650–670 million people in Africa, roughly half the population, already face food insecurity with more than 250 million people considered to be severely food insecure.

With the COVID-19 crisis disrupting regional and global trade, resulting in a slowing of demand for Africa’s agricultural export products and putting jobs and livelihoods at risk, the team at Development Reimagined wanted to understand what role China does and can play in all this.

We spoke with Cheng Cheng (程诚), Chief Economist of the Made in Africa Initiative, an international NGO dedicated to industrial development in Africa – including through agriculture upgrading, to understand more.

DEVELOPMENT REIMAGINED: Cheng Cheng, as an expert in this area, we want to start with overall policy implications and comparisons, before we discuss Chinese actions in Africa to date. Should African countries trying to follow a “China Model” for food security? What does this mean?

CHENG CHENG: China and many African countries share a similarity of smallholder farmer ownership. But unlike in many African countries, China’s constitution sets out that the government owns all the land, while rural communities, such as villages, collectively own rural land. Families tend to hand down land rights in rural areas. Before 1960s, China’s per capital GDP was lower than US$150, less than a third of Africa’s at the time. From 1978, China started a very strong collective management system for smallholder farmers. This included distributing seeds, fertilizers and other resources across villages as well as sharing new cultivation techniques among farmers, and even new technologies such as hybrid rice.

In contrast, in many African countries – even those that do have collectives or farmer unions – land rights and management systems are less organised and clear – they can vary widely even within the same countries. My view is that this is why China’s smallholder ownership has fared better than Africa’s.

The system in China – especially at early stages when incomes were still much lower, made it easier to arrange and manage other issues in agriculture. For instance, what I refer to as “micro-infrastructure”, such as irrigation systems and small roads or even storage. In China, mobilizing low-cost labour to construct this kind of infrastructure early on was quite cheap for the government, and it quickly reaped dividends in the sector by raising productivity early.

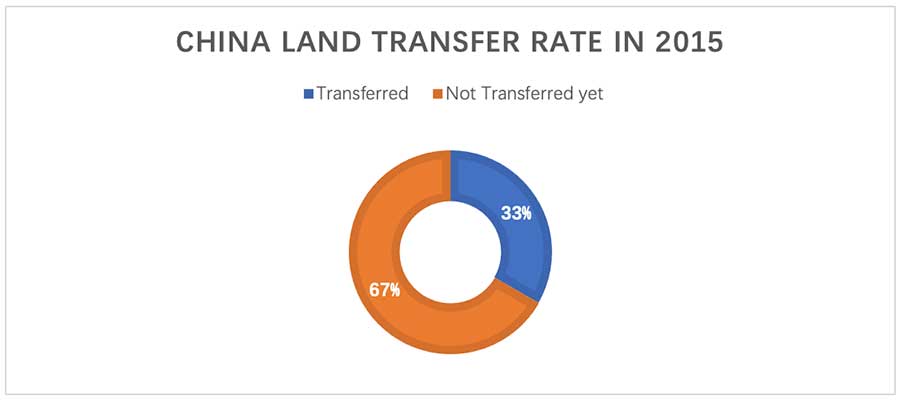

More recently, since the early 2000s, China has been transforming from smallholder farming to larger operations. A 2014 law allowed smallholder farmers to lease out their land to others. Villages are beginning to almost create joint venture companies – finding one or two very experienced and market-oriented big farmers who will cultivate most of the land with more machinery and investment. When these farmers harvest, they distribute the profits among the smallholder owners, who can choose to keep working on the land as hired farmers or go find jobs in towns and cities to supplement their incomes. Many smallholders are benefiting from this new arrangement, and it could be interesting to try out in some African countries that already have larger farms.

Sources: 王佳月、李秀彬、辛良杰:《中国土地流转的时空演变特征及影响因素研究》

But for other African countries, where smallholder farming is the majority, I do think this early investment in productivity via collectives and cheap labour deployed to provide “micro-infrastructure” consistently, is key, though of course it would not solve everything. COVID 19 might have created a perfect window for this, as doing so would also create jobs for economic recovery.

DEVELOPMENT REIMAGINED: Here is another policy issue. China currently accounts for 19% of the global population, while Africa accounts for 18%. Yet Africa’s population is set to rise to 26% by 2050. Surely this will put huge pressure on food security. Based on China’s experience, what is the right balance between exporting food and keeping food produced in-country? Any key principles African countries should be using?

CHENG CHENG: I don’t think there is one principle in China that can be adopted by Africa, especially as there are 55 African countries with very different systems – some very market oriented and some more controlled, but let me share China’s principles in any case.

The first point to note is that food security and food supply are different. The Chinese government – even now – only focuses on making sure that there are sufficient domestic supplies of a few critical products, such rice, wheat and corn (Three Staple Foods:三大主粮) and pork before such supplies are exported elsewhere. This is because the country consumes around 30% of the world’s rice, according to the OECD-FAO’s Agricultural Outlook 2019-2028, and meat (mostly pork). It has to be careful – it can’t just let farmers produce these products or switch to other products to export to international markets. But the government takes a much more “laissez-faire”, market-focused approach to supply and export of other “non-essential” products. This is how the government avoids two extremes for agriculture development: fully controlled or fully market-led.

So far, it seems African countries have real challenges in deciding between these two extremes. Even though altogether African countries have a comparable population to China, individual food security decisions are taken within 55 much smaller sovereign countries. So, I think it will be hard to apply this kind of system – unless there were of course some sort of pan-African food security mechanism. But this is an issue for African policy makers, and in the meantime, we have to find other solutions.

Indeed, I believe exporting to China is a chance to improve agriculture in Africa. For instance, Chinese per capita consumption of protein is likely to grow over the next 5 years – the high price of pork in the second half of 2019 indicates this. If African farmers can export protein products to China, such as soybeans, then of course that will improve their incomes. But the process needs to be managed well – to avoid negative impacts on food security in Africa. What we don’t want is for farmers to simply switch to only producing crops for export. Imagine all farmers growing cocoa beans instead of cassava in West Africa! Governments need to find a way to increase incentives for farmers to keep increasing their productivity while retaining a sound base for their population’s consumption of basic food.

DEVELOPMENT REIMAGINED: Let’s move to Chinese support for Africa now. What have been the biggest challenges to date for Chinese entities in supporting food security in Africa?

CHENG CHENG: If you compare Chinese investors with European or American investors, I think we all face the challenges in the African agricultural sector, some of which we’ve already mentioned… Smallholder ownership limits productivity; poor irrigation and basic infrastructure; and a lack of local supplies of machinery, fertilizers as well as cultivated seeds. And extreme weather due to climate change has increased uncertainty.

That said, Chinese investors seem more eager than others to invest in Africa. Why? In some ways it relates to their own experience of China – they see the problems in Africa but also the potential benefits because they have seen transformation at home. The problem is that the Chinese investors often lack the understanding of just how differently African markets are structured, and that’s why struggle most, while other development partners might know more, because of their historic ties.

DEVELOPMENT REIMAGINED: Can you give an example of a Chinese funded project in Africa that has successfully supported food security? Is this a model you would suggest for others hoping to invest in Africa?

CHENG CHENG: Agriculture is full of uncertainty which is both the beauty and the problem of this sector. Most Chinese investment in Africa’s agricultural sector is focused on to ‘economic crops’ – i.e. those with more certainty, guaranteed to make money such as tobacco and sisal, rather than basics like cereal crops. The reason is very simple. Economic crops have higher rewards. The problem is this might not encourage or stimulate food security in Africa.

But there are exceptions. Let me give you a few examples. Firstly, the Win-All High-Tech Seed(荃银高科) is one of China’s top 100 enterprises for foreign cooperation in agriculture, and one of just two agricultural enterprises which gets direct grants from the Ministry of Commerce – China’s primary aid department – to do work internationally. It has cultivated over 10,000 hm of rice and corn in Africa and now supplies seeds for several World Bank poverty alleviation projects in Africa. CGCOC group (中地海外集团). doesn’t just focus on agriculture but it has carried out agriculture aid projects in both Burkina Faso- on millet planting- and Nigeria, and in both locations even established local offices to continue the work. And Professor Li Xiaoyunhas been leading a team to transfer China’s techniques in corn plantation to Tanzania for many years. I believe these projects are making a strong contribution to food security in Africa.

That said, I think more varied partnerships are possible. For instance, China has a lot of technology to deal with agricultural challenges, such as the locust plague. Many African governments are still buying chemical parasites from European countries, yet this also contaminates the environment. In China, we use a special fungus to deal with locusts without harming the environment,which was also introduced to Pakistan in 2019. But so far, this has not been introduced to Africa. I think there are opportunities for more contributions like this.

DEVELOPMENT REIMAGINED: Finally, Cheng Cheng, in 2015, Deborah Brautigam wrote a book called “Will Africa feed China” which was responding to concerns that China is buying land in Africa to export agricultural products to China at the expense of domestic populations. What is your response to this?

CHENG CHENG: My own view is that China won’t import basic cereals or grains from Africa at significant scale, however, it does want to import value-added and specialist agriculture products. China’s growing demand for organic fruits, vegetables and more protein-contained products like avocado and soybeans is huge. I truly believe this is a golden opportunity for Africa.

If managed properly, having this new export market could drive up productivity of economic crops production in Africa, with spillovers into production of basic grains production and benefit incomes and food security. But if African governments don’t manage to ensure basic grain production while making the most of economic opportunities like this food security may worsen. It’s a delicate balance.

My other concern, especially as COVID19 is hitting economies, is that many African countries already import basic foods such as cereals, rather than produce them domestically. If economic growth on the continent deteriorates there may not be sufficient foreign currency to continue these imports. In this case an expansion of domestic supply of the products is needed now, yet populations are still growing. The next few months could be very challenging.

Based on Our Discussion, What Does the Team at Development Reimagined Think Can Support Food Security Based on China’s Experience?

- FIRSTLY, IN TERMS OF LAND MANAGEMENT – IT’S NOT OWNERSHIP ITSELF THAT IS NECESSARILY KEY – BUT HOW INPUTS, INFRASTRUCTURE, AND PROFITS ARE DISTRIBUTED: These collectives play a key role in sharing costs but also providing much-needed resources for farmers. By enabling these collectives China increased the production of staple goods, such as rice, for domestic consumption. China can share experience from the management and reform of these smallholder farmers to support food security in Africa.

- SECOND, INVESTMENT INTO “MICRO-INFRASTRUCTURE” AND VALUE-ADDED AGRICULTURAL PRODUCTS CAN PROVIDE JOBS AND STIMULATE TRANSFORMATION: Exports don’t necessarily need to compete with agriculture for domestic consumption. Productivity can rise overall. Smallholder farmers can play an important role in supporting domestic food production whilst large scale investments can target value-added sectors (such as the dairy) to stimulate jobs. It is worth African governments reflecting on how to ensure “spillover” effects from growing value-added sectors (for export), with partners such as China.

- THIRD, FOOD SECURITY IS NOT ABOUT CONTROLLING ALL AGRICULTURAL PRODUCTION: There is a delicate balance to be made, which China, with its comparable sized population to Africa has managed so far. The question is whether African countries can coordinate to establish food security for basic grains… perhaps the African Continental Free Trade Agreement, as well as COVID19 will act as enablers for considering such long-term solutions.

Author: Leah Lynch, Deputy Director and Jinyu Chen, Research Analyst at Development Reimagined.

This article was originally published on the China-Africa Project website on July 9th 2020

July 2020