We have been tracking African governments actions since the outbreak of the Covid-19 pandemic, and calculate that currently, African countries are spending around 2.5% of GDP to combat Covid-19’s impacts. While this is this is significantly below spending by other regions (for example the Asia Pacific region is spending 7% of GDP, and G20 countries spending 11% of GDP), set against this is a prevailing narrative that African countries owe huge debts to China, and this is impairing African countries’ abilities to address Covid-19, or indeed, to continue to function in a stable way.

While we question this narrative, there is a salient question of whether China’s debt relief efforts – from suspension to cancellation and restructuring – in the context of Covid-19 could indeed be significant, especially into the long-term? Could China actually help African countries (and other low and middle income countries) recover better from Covid-19 more broadly?

The answer is a little complex… In the short-term – yes. But long-term it depends on others – especially the IMF and bondholders… Why?

To explain why clearly and objectively, The Oxford China International Consultancy (OCIC), together with Development Reimagined, have looked at the data, conducted some innovative scenario simulations, and produced a series of infographics (download here).

Our analysis revealed five key insights.

1. Annual debt payment costs to China are higher than those to OECD governments, but below costs to multilateral banks

Total debt service for low and middle income countries in 2020 totalled USD 437bn, of which 27% was for debt owed to the Chinese government and official creditors (e.g. China Exim Bank), and 33% for debt owed to multilateral lenders. 27% in total was for debt owed to other governments and the private sector in OECD countries (i.e. including payments for “eurobonds”). The majority of debt service costs to most creditors – except for OECD governments and multilateral creditors – need to be made by African countries.

2. Debt suspension by China can help enable Covid-19 spending

While a lack of transparency from China and borrowing countries make estimates difficult, our scenario estimations suggest that overall, up to 40% of finance spent on Covid-19 so far by African countries could be covered by suspending debt payments to Chinese official creditors, and populations in some of the countries with highest debt levels to China – such as Angola, Djibouti and Zambia – could benefit the most. Moreover, further debt service cancellation in and beyond 2021 would help to continue protecting governments from the impacts of the prolonged pandemic.

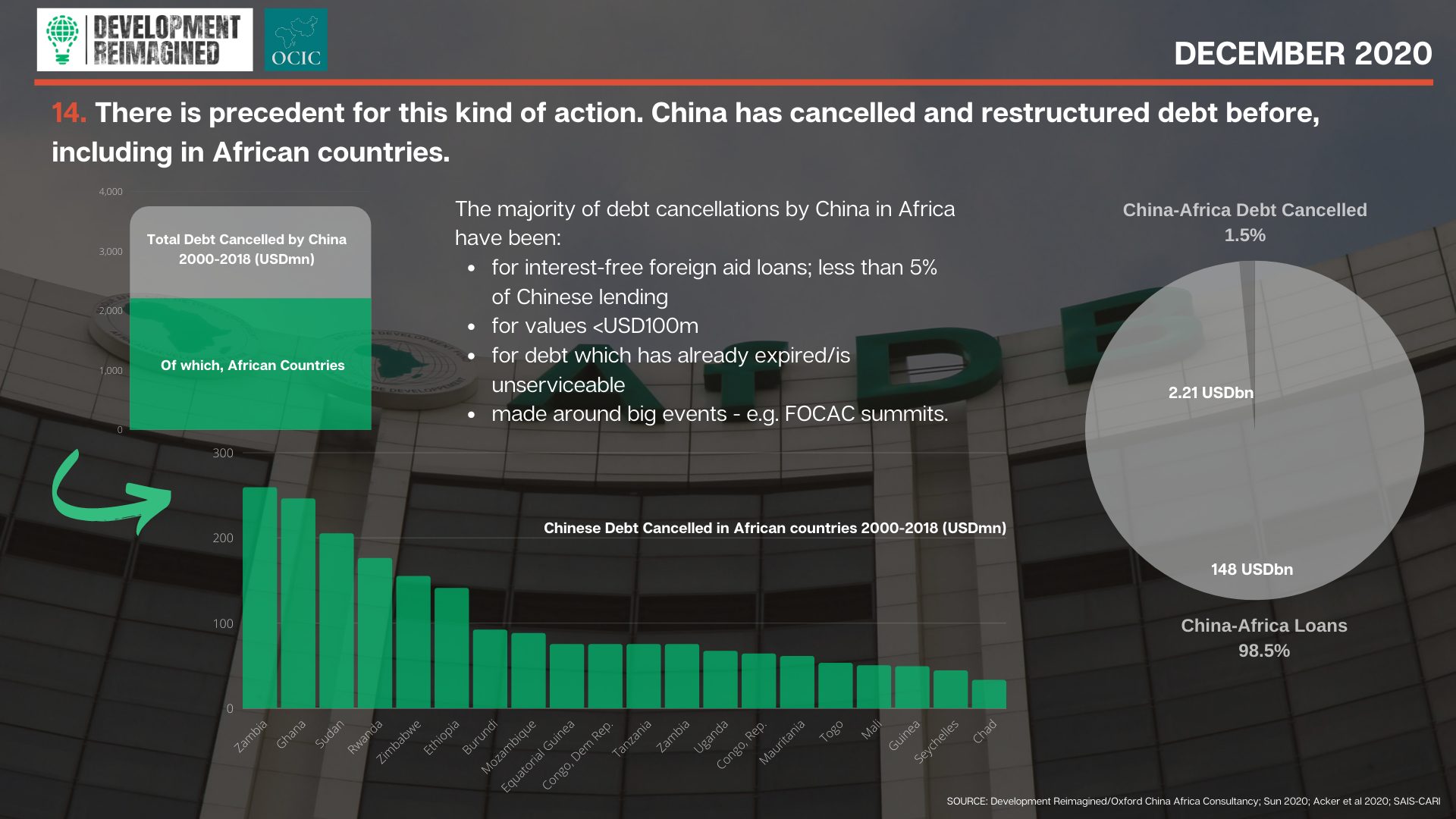

3. There is precedent for China entirely cancelling debt in African countries.

In the past, over 2000-2018, China has cancelled debt for at least 20 African countries, equivalent to 1.5% of all loans taken out across Africa from China. Most cancellations have been for amounts that are less than 100m. This precedent provides some hope for further action from China in 2021 to suspend debt payments – even if they will still need to be made in future.

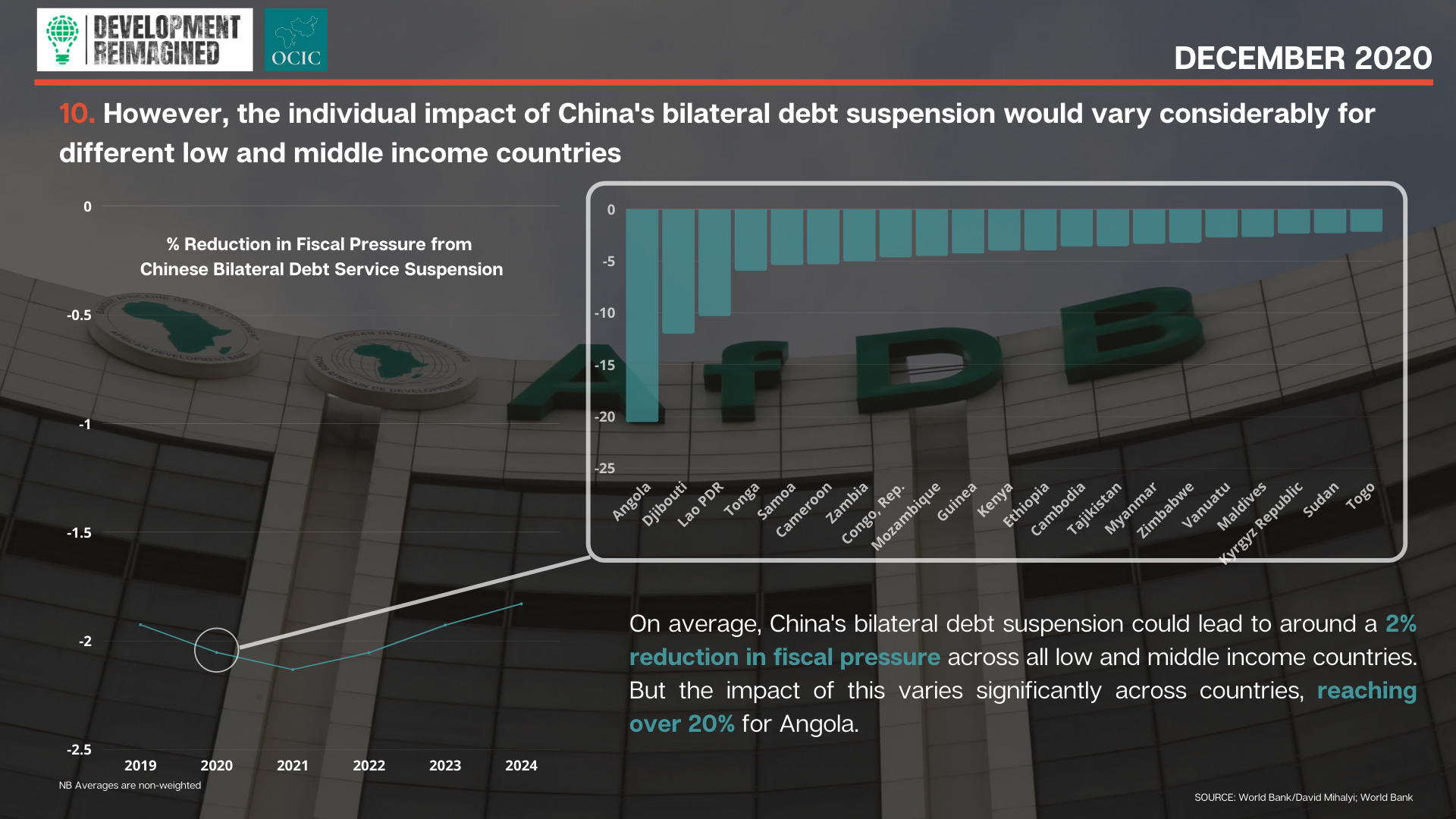

4. However, debt suspension by China will not necessarily change internal economic structures in African countries

A key issue going forwards beyond Covid-19 is whether countries need to drastically reduce spending or increase taxes or savings to compensate. This is what is known as reducing “fiscal pressure”. We calculate that bilateral debt suspension by China in 2020 could lead to around a 2% reduction in “fiscal pressure” across all low and middle income countries. But the impact of this varies significantly across countries, reaching over 20% for Angola, and 12% in Djibouti. In addition, effects will differ depending on which sectors the loans have been focused on – Chinese loans for different sectors have different costs, and projects in different sectors also have different effects on economic growth in the receiving countries. This means the impact of suspension will not necessarily be long-term, and therefore if “fiscal pressure” is required to be reduced further, countries need to take other actions.

5. Furthermore, efforts by China could also be dampened by actions and attitudes of other lenders to African countries

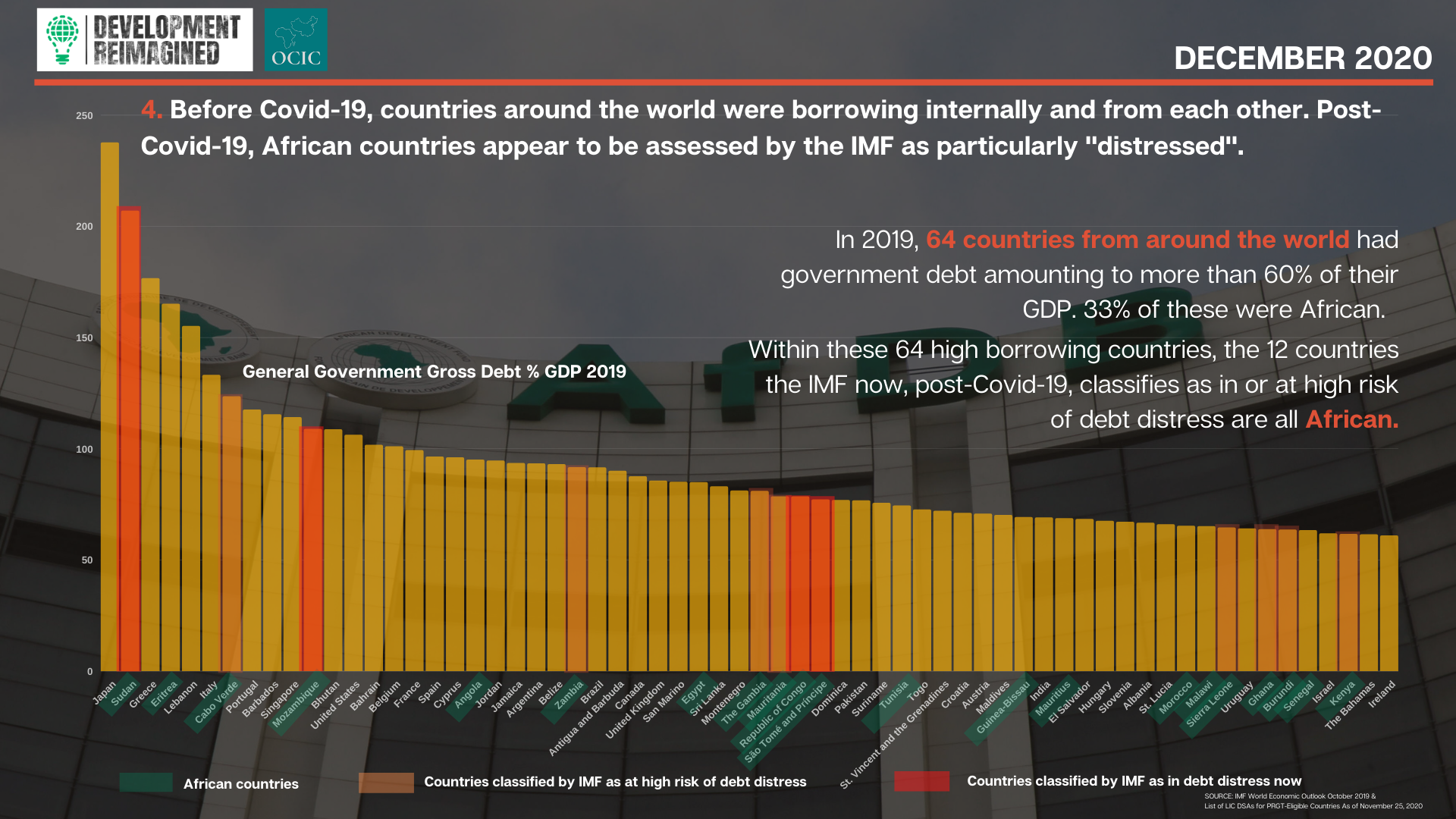

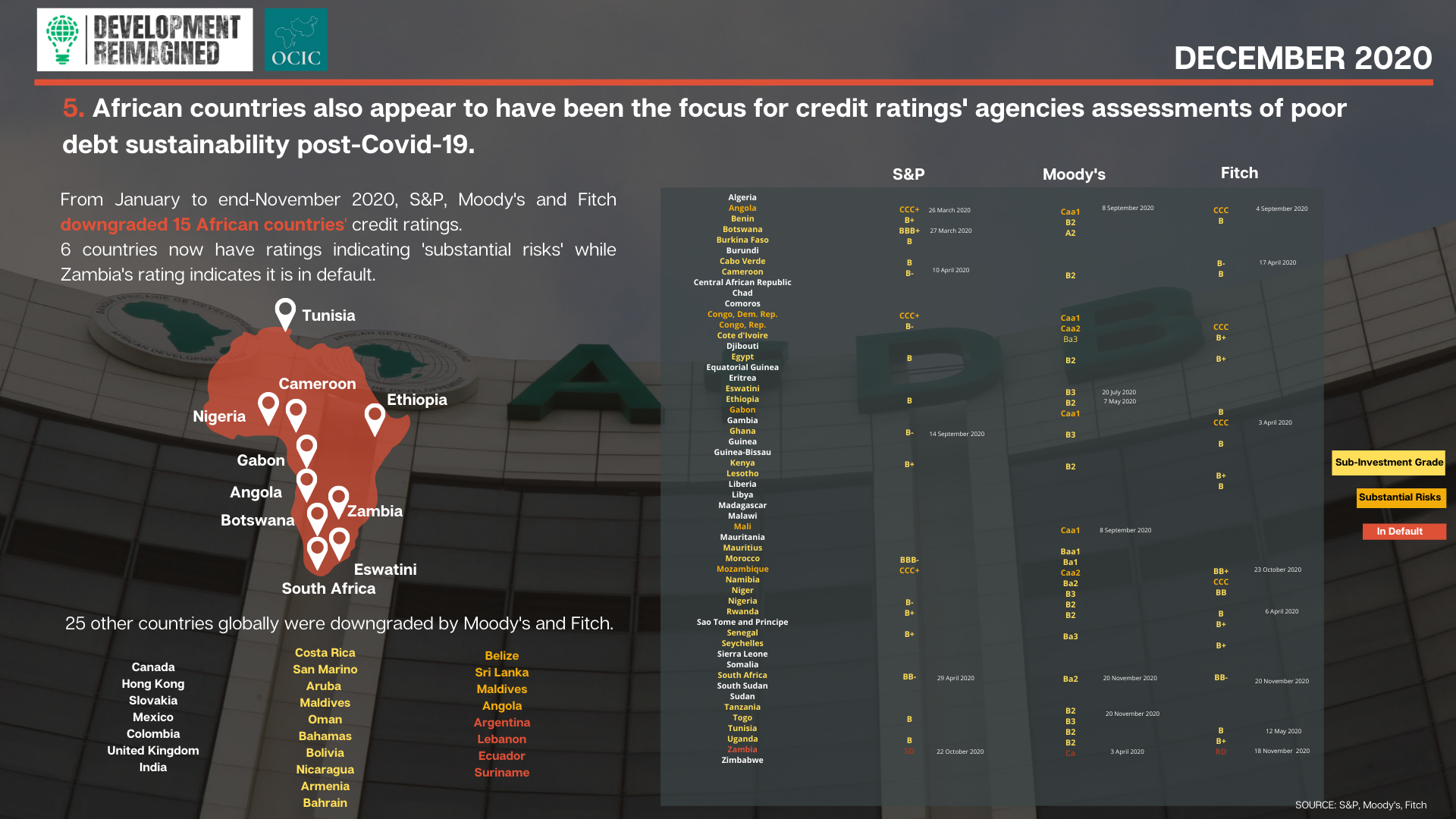

While China is a significant lender to low and middle income countries, one of the most significant challenges is one of “classification”. Many countries that arguably have the highest financial needs for infrastructure and poverty reduction, especially in Africa, appear to be disproprtionately classified by the IMF as debt distressed.

African countries also appear to be disproportionately seen as “risky” by private credit ratings agencies.

This makes African governments hesitant to even ask for debt suspensions from China or others, let alone cancellation or restructuring. Furthermore, any changes in such categories can make future loans more expensive, or even entirely stop countries from being able to access loans to support future generations. Thus, these decisions are extremely difficult.

So, what does this mean for the future, especially as Africa’s overall development finance needs continue to rise to meet poverty reduction and climate change goals?

Despite international narratives of debt distress, African infrastructure needs in transport, power and communications continue to be massively under-financed – and Covid-19 only increases this urgent need for long-term financing. While our analysis clearly shows that China could make a difference, multilateral lenders, other countries and their private sectors must also find ways to do their part – both by providing debt relief themselves but also by shifting how they see “debt risks” going forwards. Without these shifts, action by African governments and the Chinese government could be in vain.

DOWNLOAD THE FULL SET OF INFOGRAPHICS HERE

* Development Reimagined would like to thank the team at Oxford China International Consultancy, especially Charlotte Baker and Ida, for research and analysis.

December 2020