In July 2021, we hosted the first event of our Ambassadors Roundtable series with Ambassadors and their representatives of West Africa based in China. Co-ordinating across diplomatic missions in China, the focus of discussion was the challenges surrounding West African development financing strategies with respect to China in particular.

The roundtable events are part of our Africa Unconstrained project. As part of this project, we aim to challenge common narratives of an impending ‘African debt crisis’, often linked to Chinese financing. In this, there has been an overwhelming focus on debt volume when assessing a country’s debt vulnerability – rather than debt quality. Further, we have witnessed sweeping generalisations in this narrative, with 55 unique countries often categorised as a single, homogenous ‘Africa’. The Africa Unconstrained project, therefore, aims to stimulate a shift in the focus from debt volumes to debt quality within individual African countries through solution-focused discussions and analysis.

Five key points arose from the roundtable;

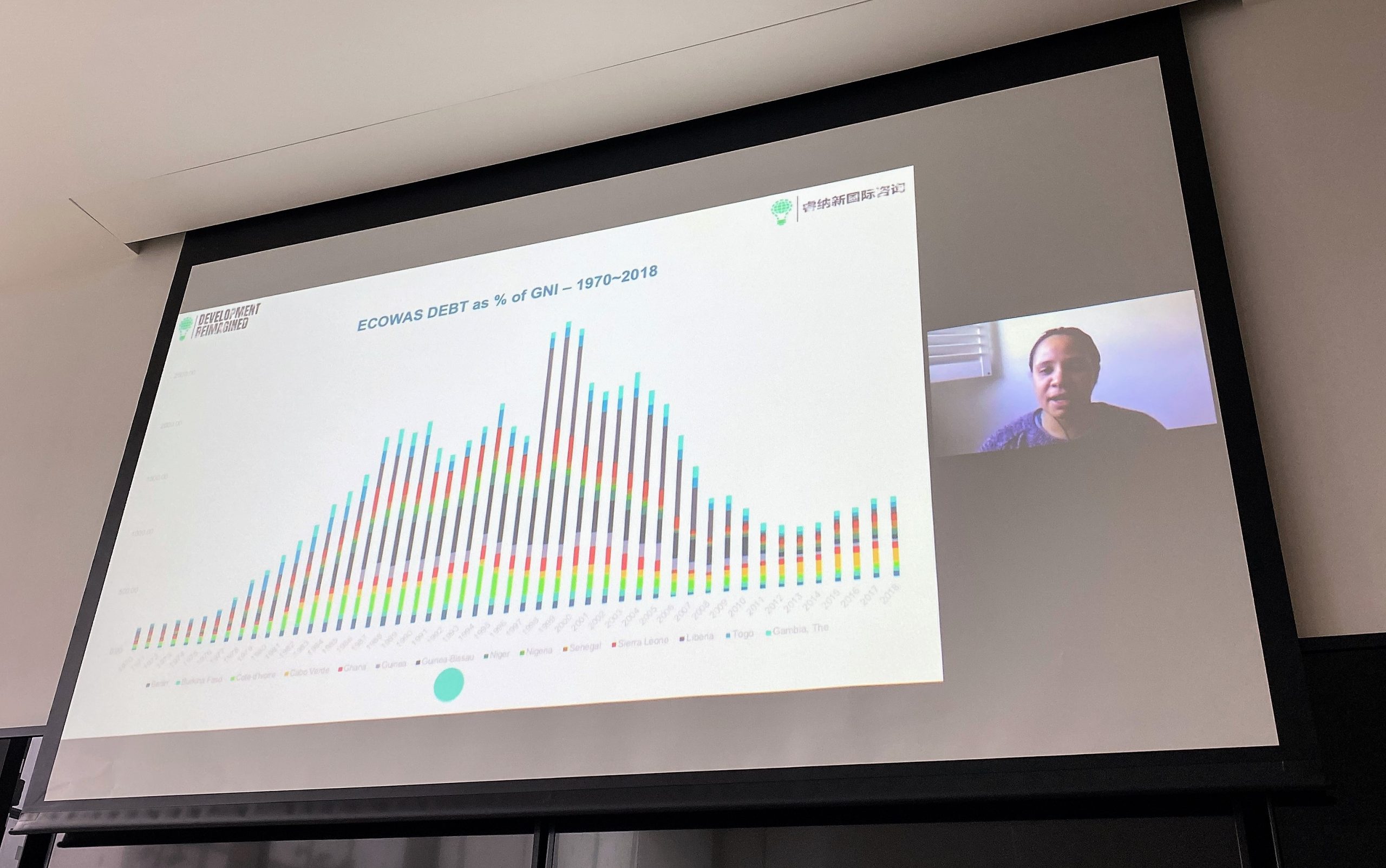

- It is essential to assess the quality of African debt – rather than just the quantity. Whilst in absolute terms, the debt of ECOWAS countries has risen, however, when accounting for debt as a percentage of GNI – which reflects the economic performance of the country – reveals that for most countries debt as % of GNI peaked in the 1980s and 1990s and the majority of debt levels are back to 1970s level of debt exposure.

- Whilst it can, at times, be difficult to align the financing needs of countries, there is something that all West African countries require – infrastructure. This is something that China has provided support with and should continue to invest in.

- Building on this, whilst Chinese investment has been particularly helpful in addressing infrastructure gaps, Chinese partners should also look to support cross-border and regional programmes in order to effectively support regional integration.

- Development partners should look to finance key industries. For example, many ECOWAS countries are dependent on agriculture to generate financial revenue, however, the sector remains significantly underdeveloped, with produce often exported raw. Development partners – China included – should therefore work with African governments to invest in the agricultural sector to develop production facilities and enhance the value chain.

- Lastly, but perhaps most importantly, further coordination is required by African governments to establish a common strategy regarding debt. A common strategy amongst African governments will increase bargaining power and is especially prominent with the upcoming Forum on China-Africa Cooperation (FOCAC) later this year, which is co-chaired by Senegal.

This roundtable was the first in a series of three roundtables aimed to bring all ECOWAS African Ambassadors together to share experiences, best practices, strategies, and challenges in their work. We are thankful to those who were available to attend, and we look forward to the next roundtable.

For further reading, you can find our recent paper on Options for Reimagining the African Debt system here and our Blueprint for a Continent-wide Africa ‘China Strategy’ here.

August 2021