Date Published: December 4, 2023.

This article was first published on Ventures Africa in December 2023 – by Ovigwe Eguegu

On 9th June 2023, the US, with Australia, Canada, Japan, New Zealand, the United Kingdom issued a statement that began with the sentence: “The use of trade-related economic coercion and non-market-oriented policies and practices threatens and undermines the rules-based multilateral trading system and harms relations between countries”.

Less than six months later, however, on 1st November, the US announced a plan to delist Gabon, Niger, Uganda, and Central African Republic (CAR) from a special trade scheme it has with up to 35 African countries known as the Africa Growth and Opportunity Act (AGOA). The announcement came a day to the start of the 2023 AGOA forum in South Africa, designed to discuss a potential renewal to AGOA from 2025 onwards. By blacklisting these countries the US was itself using AGOA as a stick, a tool of economic coercion to achieve political objectives. The problem is, not only was this hypocritical but AGOA has never been a big enough economic carrot. Both these factors – if not addressed – pose major challenges to US foreign policy going forwards.

AGOA has grown limited African exports

Since its inception in 2000, the innovative trade scheme AGOA has offered preferential market access opportunity for eligible African countries, and for an extensive range of products including manufactured items, not just commodities. For these reasons, and especially prior to the introduction of the African Continental Free Trade Area (AfCFTA), it is an excellent scheme in principle, and can even be seen as a model for other development partners.

However, for various reasons, two decades later, much of AGOA’s success has been concentrated in a few countries and a few industries and sectors. For instance Kenya and Lesotho boasts some of the highest AGOA utilization rates: the share of their exports to the U.S. that qualify for zero-tariff treatment is 88 per cent for Kenya, and as high as 99 per cent for Lesotho. However, both nations’ exports to the U.S. were mostly apparel items. Conversely, over the same period nearly half of all beneficiary countries have a utilization rate of 2% or lower, implying that 98 percent of U.S. imports from such countries were subject to US tariffs. As a result of this, for instance, a model designed by an economist to predict the impact of AGOA not being renewed for South Africa or South Africa losing AGOA benefits (for example due to blacklisting) suggests that at worst, South Africa’s total exports to the US would fall by about 2.7%. “In aggregate, a loss of AGOA would lead to a decline in SA’s GDP of just 0.06%.” This remarkably small effect is ascribed to two factors — “the nominally higher tariffs on SA exports to the US and the composition of SA’s export basket.”

This challenge has borne out in reality, for instance in Ethiopia, a country that the US blacklisted from AGOA in 2021 due to “gross violations of internationally recognized human rights.” In 2021, 93.1 per cent of all apparel from AGOA countries entered under the AGOA programme. That figure dropped to 68.3 per cent in 2022 due to Ethiopia’s exports entering the US outside of the AGOA programme. This means that Ethiopian goods had strong demand even without preferential treatment. There is no doubt that Ethiopia is better inside AGOA than out, but the competitiveness of its exports meant being cut off from AGOA was a pinch not a punch.

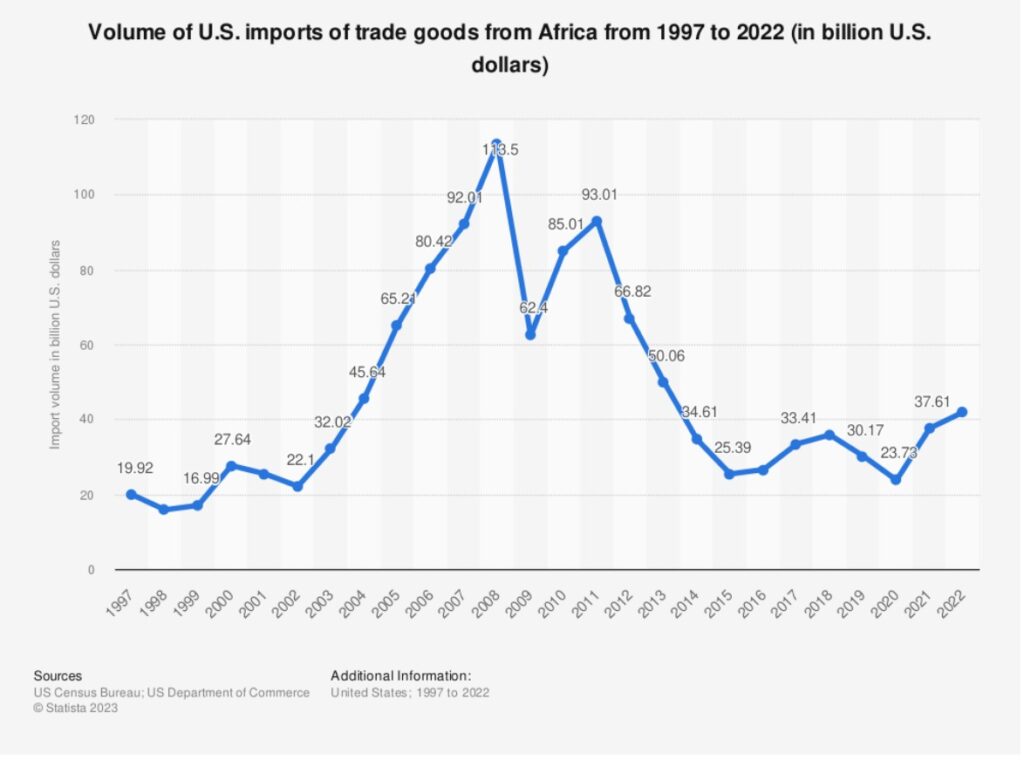

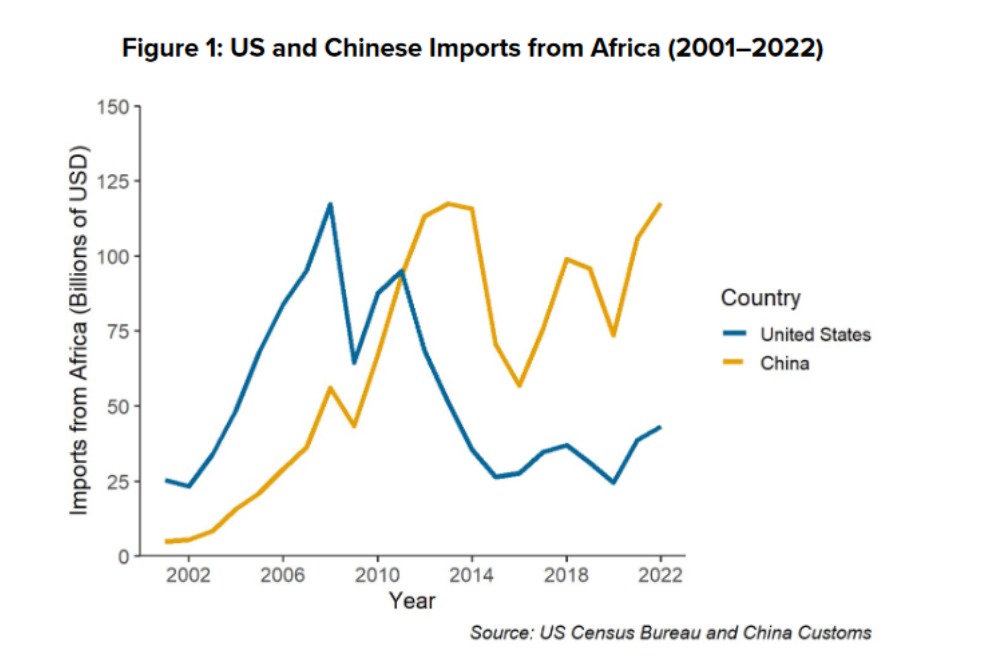

Perhaps most damming, figures show that AGOA has made little in-roads in expanding the market in absolute or relative terms for African countries in the US since its inception. African exports to the US as a percentage of overall US imports have declined from 2.27 per cent in 2000 to 1.06% per cent as of 2022. The fact is, Africa’s trade with China, the EU and India have all eclipsed US–Africa trade since then.

AGOA as a tool of coercion

However, while the carrot of the AGOA has hardly grown, the intentional use of AGOA as a tool of coercion (effective or not) has grown. Since the inception of AGOA, 18 countries have at some point been delisted from by the U.S. starting in 2003 when the Central African Republic and Eritrea were removed. There are instances where a country loses and regains its eligibility like Madagascar which was delisted in 2010 and regained its eligibility in 2015.

Certainly, Washington sees the recent a spate of coups in West and Central Africa, as well as Africa’s growing political and economic ties with Russia and China as a threat to its influence on the continent. However, blacklisting is a poor means to gain back that influence because trade is too small.

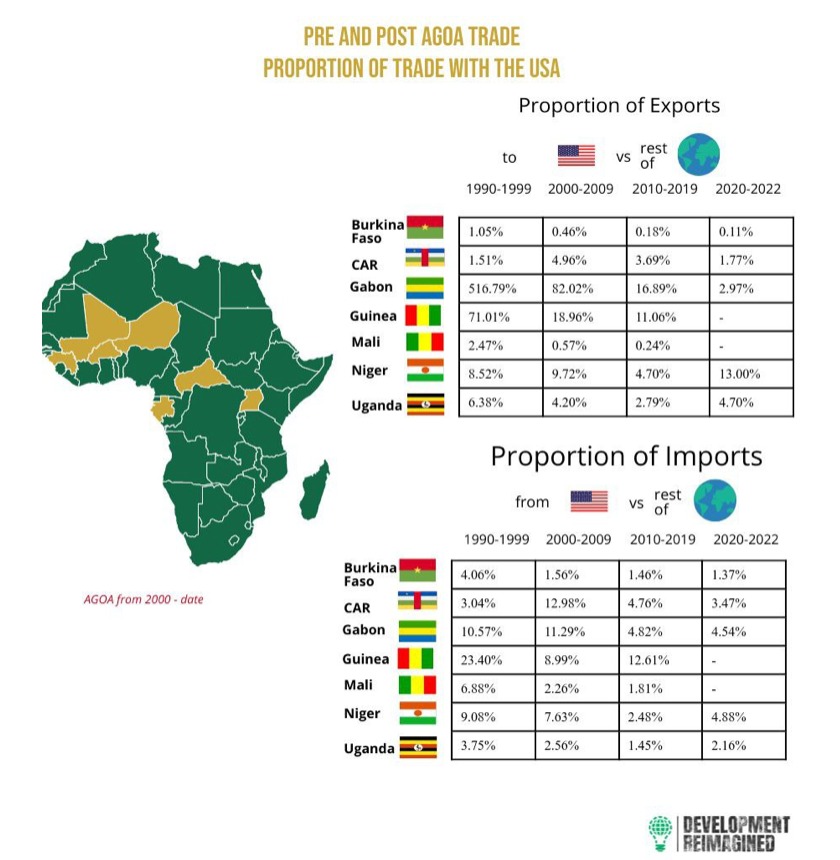

Moreover, although the four criteria for blacklisting African countries from AGOA is transparently written into US legislation, their application has been highly inconsistent. For instance, while Mali and Guinea or Burkina Faso are now ineligible for AGOA on the grounds of being military governments, Chad maintains eligibility while having a military government in place. Hence, the concern that AGOA is being used politically for coercion, rather than the simple application of US multilateral principles.

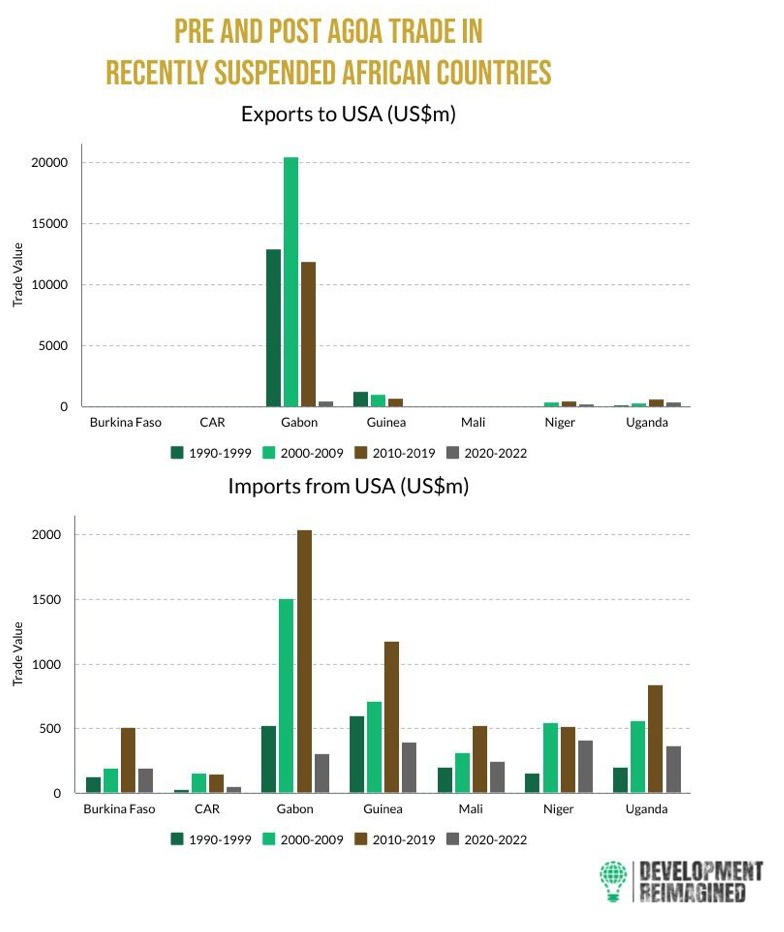

Furthermore, countries like Mali, Burkina Faso, CAR are making aren’t just undergoing political transitions, they are making profound geopolitical reconfigurations. They do not view themselves as allies of the United States and are not major beneficiaries of AGOA. Gabon, for instance, has a significant trade deficit with the United States of US$87 million in 2022, with the majority of Gabon’s exports to the US being commodities comprised mainly of manganese ore, and refined petroleum. In turn, US exports consisted of poultry meat and excavation machinery. Similarly, Guinea exported $8.49million worth of goods to the US while the US exported US$134 million to Guinea. It therefore comes as no surprise that these countries, and others such as Mali – having been delisted over a year ago – has not made any reported effort to be reenlisted. if anything, the Junta in Bamako has pressed on with power consolidation, and with enhancing bilateral relations with Russia.

US-Africa trade has declined as Africa’s trade with others soar

The fact is, while US exporters and private sector players have found new markets in the continent, data from Statista shows that US exports of trade goods to Africa has nearly tripled from $10.97 billion in 2000 to $30.69 billion in 2022, however, trade volumes in the opposite direction and under AGOA have never grown large enough to matter to many African countries. Too little effort has been put into making the carrot grow.

This will become an even stickier challenge for the US especially as the same goods are increasingly finding markets in other countries, including emerging economies such as China, perceived to be a US rival.

For instance, in 2021, CAR imported goods valued at US$23 million from the United States, while exporting goods of just US$881 thousand to the US, a massive deficit. In contrast, CAR exported US$31 million worth of goods to China, even though the majority of said value is from oil and commodities. However, countries such as China, India and Brazil are all starting to make more targeted efforts to open their markets to African products, not just altruistically as a development tool, but also as a means of diversification of their own supply chains.

The coming into force and operationalization of the AfCFTA, with its goals for regional integration, will also create larger markets for African countries internally, again, dampening the impact of any US preferences or delisting.

That is, unless the US makes major changes to how it sees and uses AGOA, quickly.

A renewed AGOA

As the US and G7 partners have themselves realized, and spoken out against, using trade as a coercive tool is harmful to foreign policy and multilateralism. It also creates uncertainty for the domestic and international private sector – witness the exit of US firms from Ethiopia in 2021. Indeed, a sound trade policy should facilitate the achievement of both economic and strategic goals.

The primary aim should therefore be to grow trade, and then work to shape it.

The US orienting AGOA towards a goal, for instance, of the African continent providing at least 5 percent of US imports from worldwide within 5 years would be excellent from the point of view of African countries but also from a domestic perspective of, for instance, diversifying the US’ own global supply chains. Such a goal would also incentivize significant creativity by both US and African government agencies and the private sector on all sides, including driving new investments in value-addition on the African continent, into both minerals and other sectors.

The fact is, there are multiple ways a renewed AGOA that was being discussed in South Africa last week could create a much bigger carrot, an economic cooperation, win-win success story for both the US and Africa in future. The first step, however, will be for the US to take its own medicine and stop using AGOA as a stick for economic coercion.