Whether it is ordering a vegetarian wrap or having a healthy fruit and veggie smoothie, the most sought after ingredient I crave for is avocado! Today, be it Beijing or Shanghai, restaurant chains and smoothie bars, are now catering to their customers’ healthy tastes, delivering on this fruit in different meals and drinks. Whether fresh or frozen, there is always an intriguing story behind how these fruits end up in China because most are not grown domestically, they’re imported.

At Development Reimagined we look for growing trends and work with our clients to find innovative ways to address some of these trade patterns that emerge. The case of Kenyan avocados being exported to China presents interesting lessons for other African countries hoping to export to China.

In particular, was sustainability and poverty reduction at the forefront of the deal?

But first, some background.

Avocados grown in Kenya make up about 17% of the nation’s total horticultural exports. Amidst COVID-19, Kenya recently announced that in the first half of 2020 they had sold 58,400 tonnes of avocados, exported to 42 countries. Some of the countries Kenya already exports fresh avocados to include Netherlands, Spain, United Arab Emirates, Russia, France, and Belgium. However, Kenya only exports 10% of its produce whereas South Africa and Chile export 60% and 55% respectively. Chinese locally grown avocados in provinces like Yunnan are slowly gaining traction with an estimated 3,318 hectares which is still relatively small compared to the 13, 017 hectares in Kenya and 29,000 hectares in Chile.

What Does It Mean for Kenya To Be an Emerging Avocado Market?

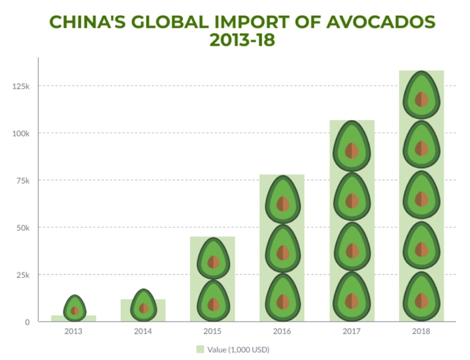

Between the years 2013 – 2018, the value of avocados imported to China grew by an average of 17%reaching $133 million and a total volume of 42 million kg a unit in 2018. This increasing demand reveals the vast opportunities presented for the exporting countries. In 2018, the countries with the largest value of avocado imports into China were Peru (37%), Mexico (36%), Chile (27%), and New Zealand also exporting a smaller fraction.

In 2017 Kenya decided it wanted to be a new player in this market. In particular, Kenya’s plan was to be the first African country to export Haas avocados to China – which is the popular choice followed by Furte. This plan was also in the context of a list of several other agricultural products that Kenya wanted to get permission to export to China, including tea and stevia. Why? Between 2014-2018, Kenya reported an unsustainable trade deficit of $15 billion (SH1,622 billion) with China – in other words – for every dollar that Kenya exported of goods to China, Kenya imported 36 dollars’ worth of goods back. While China is not the only country Kenya has a trade deficit with, as a country wanting to create jobs and growth, promoting the export of agricultural products from Kenya to China was a crucial step. But first, and unlike many other export destinations or even Kenya itself, China had to grant permission for avocados to be exported. That meant a visit to Kenya by China’s standards authorities to inspect the avocado farms.

What About Small-Holder Farmers?

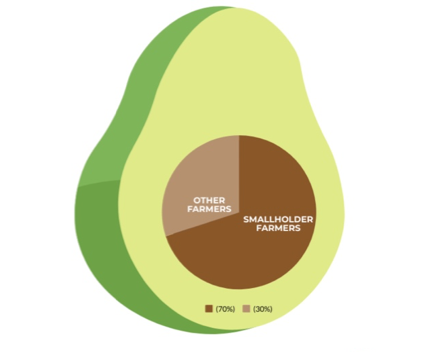

In Kenya, 70% of the avocado growing is by smallholder farmers, who typically can make between 600-800 fruits per acre per season. The average amount a farmer makes from each fruit is $0.46, meaning they are bringing in between $276-368 per season that goes towards supporting their families and communities. This is also a means of poverty alleviation in the avocado growing regions of Kenya.

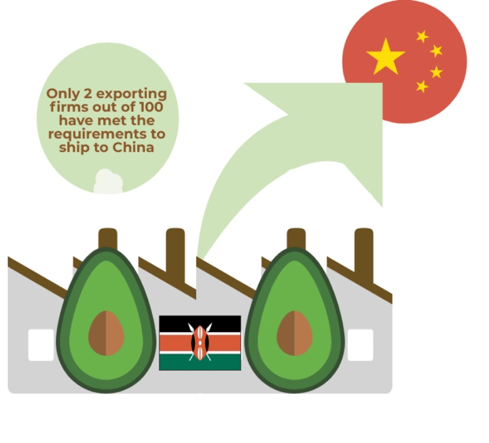

When China’s authorities inspected the farms, due to concerns over, “fruit flies, scales, and traceability.” they determined that Kenya did not fully meet the phytosanitary regulations for exporting fresh avocados – and thus stated that the Hass avocado producers must first cut, pack and freeze the avocados before exporting to China. This was a huge hurdle for smallholder farmers who do not have the equipment or the infrastructural support to meet these freezing requirements. The Kenya Plant Health Inspectorate Service (Kephis), the designated body that oversees the export process, has explicitly recognized how limiting the current conditions are on smallholder farmers. It is projected that Kenya will export up to 40 percent of its avocado produce to China however if smallholder farmers are excluded, this figure along with the projected growth will not be realized. Since the barrier was lifted in April 2019, only two firms have managed to meet the requirements to ship to China – Sunripe-Vertical Agro EPZ Limited and Direne Packaging – that’s two exporting firms out of what could be over 100 exporting firms.

Is Frozen the Future?

That said, as much as Kenyan avocado farmers are struggling to adapt to these conditions, there is a market for frozen avocado. The demand for frozen avocados is growing because of their convenient form and some have described the linkage between frozen food and decreasing food waste. Mr. Tiku Shah from Sunripe-Vertical Agro EPZ Limited added that “for frozen avocados, you will peel and throw away 50-60% of the fruit and so you end up paying double for it yet you eat everything you buy and you can have it when you need it whereas with fresh you don’t know when it will ripen.” Furthermore, frozen avocados are said to have a shelf life of up to two years. Kenyan avocado exporters believe that the market for frozen avocado is mostly within the catering industry where frozen avocados can be used for smoothies or other products such as yogurts.

If the exporting conditions remain as they are, therefore, for smallholder farmers to benefit, a tremendous upgrade of the existing value chain to include cutting, peeling and freezing facilities alongside upgrading Kenya’s cold chain infrastructure would be needed. Individually Quick Frozen (IQF) technology has been reported to allow frozen avocado producers more convenience. The Ministry of Trade has committed to providing additional support to smallholder farmers by working with Kenya National Trading Corporation, but it will take a lot of effort – and money too.

Should Kenya Settle For What It Has Now Or Negotiate a New, Better Deal With China?

The answer is both are needed. They are not mutually exclusive. Indeed, Kenya has the potential to increase a wide range of avocado product exports to China as consumer’s appetite towards the fruit continues to grow.

In this respect, as development partners, we propose that Kenya and China consider the following next steps:

- HELP VERTICAL INTEGRATION PLAYERS TO SCALE-UP: The Kenyan Government could take the lead working with Kephis, and the Kenya National Trading Corporation in identifying more vertical integration players in the market, supporting them in upgrading their cold chain infrastructure so as to assist smallholder farmers to still have access to the China market.

- INVEST INTO THE COLD CHAIN INFRASTRUCTURE: China could assist Kenyan Government in this upgrade process with direct aid or by offering tax breaks for importing such machinery.

- INVEST INTO VALUE-ADDITION OF AVOCADO PRODUCTS IN KENYA TO EXPORT TO CHINA: There is now an opportunity to develop and export more value-added products such as avocado oil and baby food to China. One of the avocado producers in Kenya, Sunripe-Vertical Agro EPZ Limited expressed interest in this, and again, China could assist Kenyan Government in this upgrade process based on China’s already stated commitment to “import more value-added agricultural products.”

- CONSTRUCTIVE RENEGOTIATION: Fresh avocados are not just important in terms of “brand Kenya”, they are also important for smallholder farmers who had hoped to gain direct access to an additional market. Kenya has stated that it is ready to demonstrate its commitment to address the concerns raised by the previous visitors, a second visit and analysis should be conducted as soon as possible.

- SOUTH-SOUTH KNOWLEDGE EXCHANGE: Kenya could use this as an opportunity for knowledge exchange to share and draw lessons from fellow Global South countries like Peru and Chile on how they navigated such challenges.

- MARKET ALL KENYAN AVOCADO PRODUCTS HARD IN CHINA: Better support for Kenyan producers to connect them to markets where there is a demand for frozen avocados in China.

- FOCUS ON GROWING SUSTAINABILITY: Kenya needs to ensure that it starts planning how to meet demands for the growth of the avocado export industry in a sustainable manner. Lessons can be drawn from other countries exporting avocados and some of the environmental challenges that they are facing mainly water scarcity and deforestation.

The initial deal between Kenya and China on avocados was seen by many as disappointing. But over the last few months companies such as Sunripe have shown they can adapt fast and capture the opportunities, even in a COVID19-constrained environment. China and Kenya have an opportunity now to hold true to their commitment of correcting the standing trade imbalance and using products like avocado to display how it is possible to use agricultural products to alleviate poverty and drive sustainable development.

A special thank you goes to Mr. Tiku Shah from Sunripe-Vertical Agro EPZ Limited (video above) and the Embassy of Kenya in China for their inputs into this article.

***

This article was originally published on the China Africa Project Website on September 25 2020

Samu Ngwenya is Policy and Research Analyst at Development Reimagined

October 2020