This week, the United Kingdom held the UK-Africa Investment Summit, whereby the country committed to strengthening its economic partnerships with African nations and announced commitments to support job creation, trade and investment across Africa, including a £20 million programme that will support businesses in developing countries to increase trade with international markets, such as China.

The initiative-Trade Connect- will support African businesses to grow and export around the world. And with China one of the biggest consumer markets, growing at a massive 16% per year, now is the time for African businesses to scale up and capture the window of opportunity offered by China.

The trade relationship between China and Africa is expanding year on year, however so is the trade deficit – with African countries on average trading at a 30:1 import to export ratio with China. This pattern continues across G20 countries with on average just 3% of all products imported by the G20 coming from Africa!

These stark trade imbalances severely impact the capacity of African countries to create jobs, earn foreign exchange, and develop sustainably to cut poverty – calling for a more sustainable Africa-China or Africa- EU relationship will help alleviates the acute trade imbalance.

But, in real terms how can African countries increase trade and subsequently support poverty reduction and sustainable development on the continent?

There are two strategies for increasing imports from Africa: increase the volume of African exports or increase the value of African exports.

Geographical indications tackle the latter – value and the UK Trade Connect Initiative could take a leading role in supporting African countries with this.

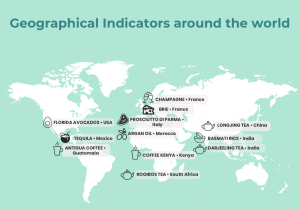

Geographical Indications grant distinct rights to “the qualities, characteristics or reputation of the product essentially due to the place of origin,” according to the World Intellectual Property Organization (WIPO). In other words, GI protection allows producers to raise retail prices.

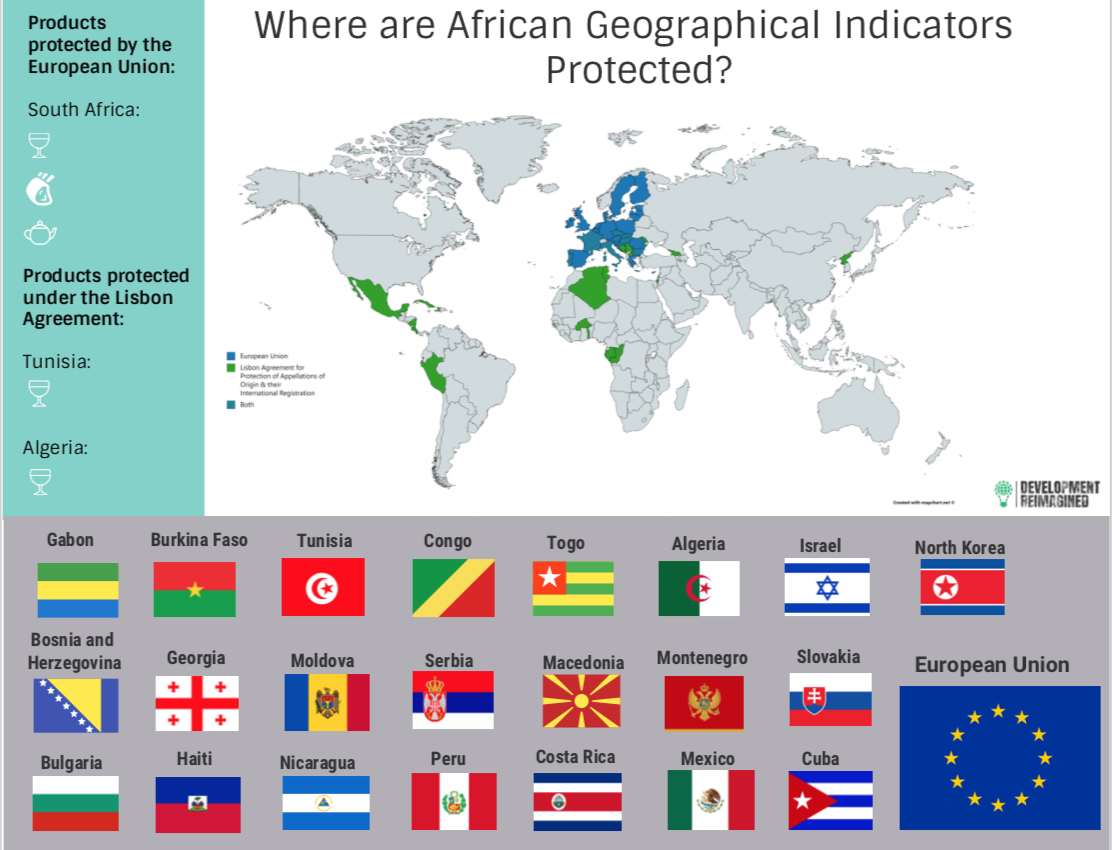

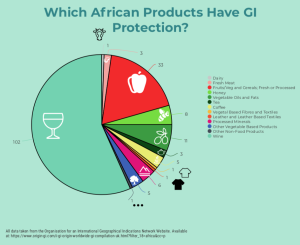

So far there are a total of 186 African Geographical Indications documented in the Origin database. Broadly, they fall into two categories: food and non-food products.

African food products with GIs are very diverse. They include Guinean and Ethiopian coffees, Cameroonian honey and pepper, Mozambican goat meat, and Kenyan tea. However, all food product GIs, except for one, are only protected at the national level. The exception is South African lamb, which is protected in the EU. Especially important is the fact no African food product GIs are protected in China.

For non-food products, wines account for majority of African GIs. Over 100 African wine brands have GIs, most of which are protected in third countries. However, again no African non-food GIs – whether protected elsewhere or nationally – are protected in China.

This lack of GI protection in China and elsewhere is increasingly important because while African products are not yet GI protected in China, a few GI products are certainly set to grow there such as South African wines, South African rooibos tea, and Kenyan teas.

At present, the African Union has a strategy for promoting the adoption of GIs, particularly in the agricultural sector. The EU is also working with African regional blocs such as the East African Community to increase mutual recognition of GIs. But nothing has been achieved yet with China. It’s a gaping hole in international cooperation.

Therefore, at Development Reimagined, we have the following 4 recommendations for African leaders and the Chinese Government, but also for the UK Trade Connect Initiative, that has the opportunity to make a substantial difference by thinking innovatively about trade:

First, we should ensure protection of African goods in China but also in the EU, so that brands reap the benefits of their innovation. The African Union and African governments should push for GI protection in conjunction with their signing of MOUs and removing other non-tariff barriers. Specifically, the Chinese government should also promote further agreements that guarantee mutual recognition of IP and GIs in China. South African wines, Rwandan coffees, and Egyptian cottons are already for sale on Chinese e-commerce platforms Alibaba, JD, and TMall. However, most are not protected. There must be increased cooperation and legal support for these producers and products- an area Trade Connect can support.

Second, we should encourage more partnerships between Chinese investors and African brands. Through Development Reimagined’s partnership with the Made in Africa Initiative, we encourage Chinese companies not to just distribute their products in Africa, but to actually invest and build factories there. Some are starting to build factories to serve domestic markets and the EU, where GIs and IP are well protected. More factories should also be built to directly serve the Chinese market. This is a ripe area for investment and would help countries diversify out of agriculture and commodity-based production, following China’s example.

Third, we should make the Chinese market easier to navigate for African brands. The vast majority of these brands are fairly small-scale, so they need cheap and easy access to information about how to register GIs and other IPs in China. Sustainable, market-led support for these small players is badly needed.

And fourth, we should encourage Chinese tourism in African countries that is specifically designed to increase exposure to GI products and brands. The experience of Longjing tea attracting tourists to Hangzhou and vice versa is a perfect example of this match. Products such as South African rooibos tea have developed appeal for an increasing number of Chinese consumers through their travel to South Africa. A great deal more can be done with variation on this theme – and with growing Chinese outward tourism every year, there is every reason to harness this spending power in Africa.

Geographical Indications represent an opportunity for African countries to be proactive in protecting their already rich and unique intellectual, cultural, and territorial heritage. Protecting GIs does come with more capital investments up front in legal fees as well as education to institutionalize processes; and it does rest on a country’s capacity for international cooperation and governance. Therefore, it is important governments and programs, such as Trade Connect, create initiatives that enable this.

In the long term, adding value with GIs diversifies risk away from commodity prices, and instead builds a platform for sustainable growth that will lead Africa into the future.

January 2020