Development Reimagined’s new report reveals that five selected African countries – which have either been classed as “in debt distress” or as “high risk” – will need to spend between 9% – 58% of GDP annually on infrastructure spending to meet the Sustainable Development Goals (SDGs).

This new report by Development Reimagined on the infrastructure financing needs of five African countries – the Republic of Congo, Morocco, Mozambique, Sudan, and Tunisia – highlights that a huge amount of external, concessional finance is required to meet the SDGs.

Numerous international organizations stress the importance of infrastructure for development. Yet, there is a severe lack of analysis on the actual infrastructure financing needs of the continent, making it increasingly difficult to identify the actual costs required to meet these needs – including the SDGs. Without knowing the quantifiable costs to meet infrastructure needs, effective spending on vital infrastructure becomes increasingly challenging.

To address this data gap, Development Reimagined has designed an econometric model to predict the infrastructure investment spending needs of the five African countries from 2022 to 2030 under two scenarios – Business as Usual (BaU) and Meeting the SDGs.

The reason for selecting these countries is that they are classed by the IMF and World Bank as having a high debt-to-GDP ratio beyond imposed limits alongside a history of engaging the IMF for bailouts. The Republic of Congo, Mozambique, and Sudan are classed as “in debt distress” by the IMF and World Bank’s Debt Sustainability Analysis (DSA), meaning that these three countries have already breached the nominal 60% debt-to-GDP ratio.

For emerging markets in market-access countries, the threshold is set at 70% debt-to-GDP, with Tunisia breaching this and Morocco being close. All five countries have not applied to the Common Framework.

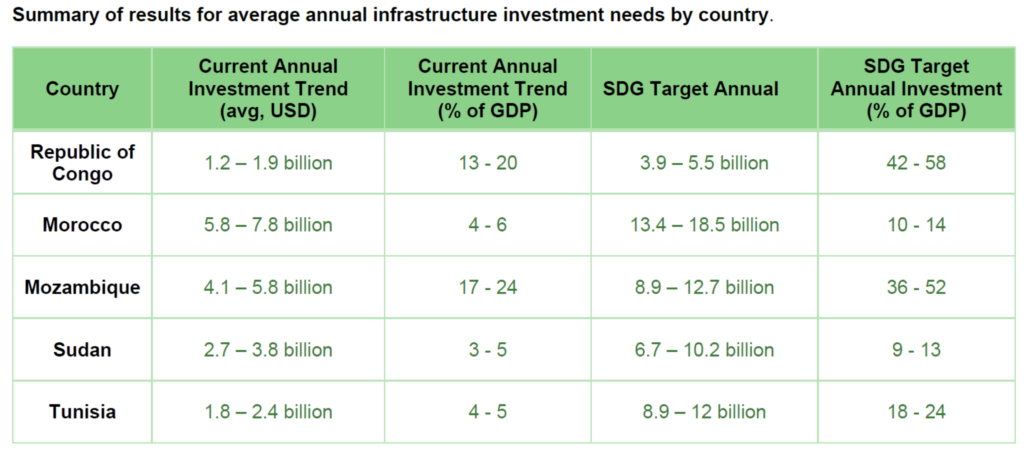

We found that each country’s infrastructure investment needs multiply in varying proportions. For these five countries, annual investment needs will range from USD 3.9 – USD 18.5 billion, meaning that the equivalent of 9 – 58% of GDP will need to be set aside each year solely for infrastructural development.

The report goes into depth by breaking these investment costs down across 9 key infrastructure sectors. For all five African countries, road, energy, and port infrastructures constitute the sectors with the greatest infrastructure investment needs.

To meet the SDGs on road infrastructure alone, the Republic of Congo would need to spend USD 16.6 – USD 25.8 billion, whereas the remaining four countries would need to spend USD 45.5 – 70.8 billion (Morocco), USD 34.8 – 54.2 billion (Mozambique), USD 20.8 – 32.3 billion (Sudan) and USD 34.9 – USD54.3 billion (Tunisia).

The scale of financial commitments required highlights the urgent need for greater levels of infrastructure financing in these countries, but more importantly, indicates how significant a role infrastructural development plays towards broader economic growth.

Finally, the report highlights the relationship between the IMF and World Bank’s DSA and the inherent bias towards African countries, providing strategic recommendations for African and international stakeholders to push for DSA reform to be accommodating towards growth-producing assets funded by debt. We also encourage African governments to consider conducting their own DSAs as a benchmark to compare with the World Bank and IMF’s DSA thresholds.

Our previous forecasting report, which covers Ethiopia, Zambia, Kenya and Chad, is also available here.

The full report can be downloaded in the button below.

September 2023