A new report by Development Reimagined is the first ever attempt at providing an in-depth analysis of Chinese investment into overseas climate funds and to what extent justice, equity, diversity and inclusion (JEDI) is a key consideration for private Chinese investment in climate funds.

While there is widespread acknowledgement that increased public and private climate investments are desperately needed to achieve global climate goals, especially in low-and-middle-income countries (LMICs), the important role Chinese investments can play in achieving these goals remains largely unexplored.

Increased climate finance is vital to developing greener economies and more sustainable societies, with an estimated $22 trillion required between 2020 and 2060 if countries are to reach the global net-zero target. In addition, climate finance needs to be directed to where it is most required and most transformational for climate action.

This report therefore focuses on the nature of private sector Chinese investments and the important role these investments can play in achieving climate and sustainable development goals. In doing so, this report adopts a JEDI lens to see if and to what extent justice, equity, diversity and inclusion (JEDI) is a key consideration for private Chinese investment in climate funds. The report highlights the importance of diversity as a key driver of innovation in climate investing and that a lack of diversity in portfolio companies only helps to maintain a cycle of exclusionary investment that does not ultimately help the groups most affected by climate change.

The report reveals the following key findings:

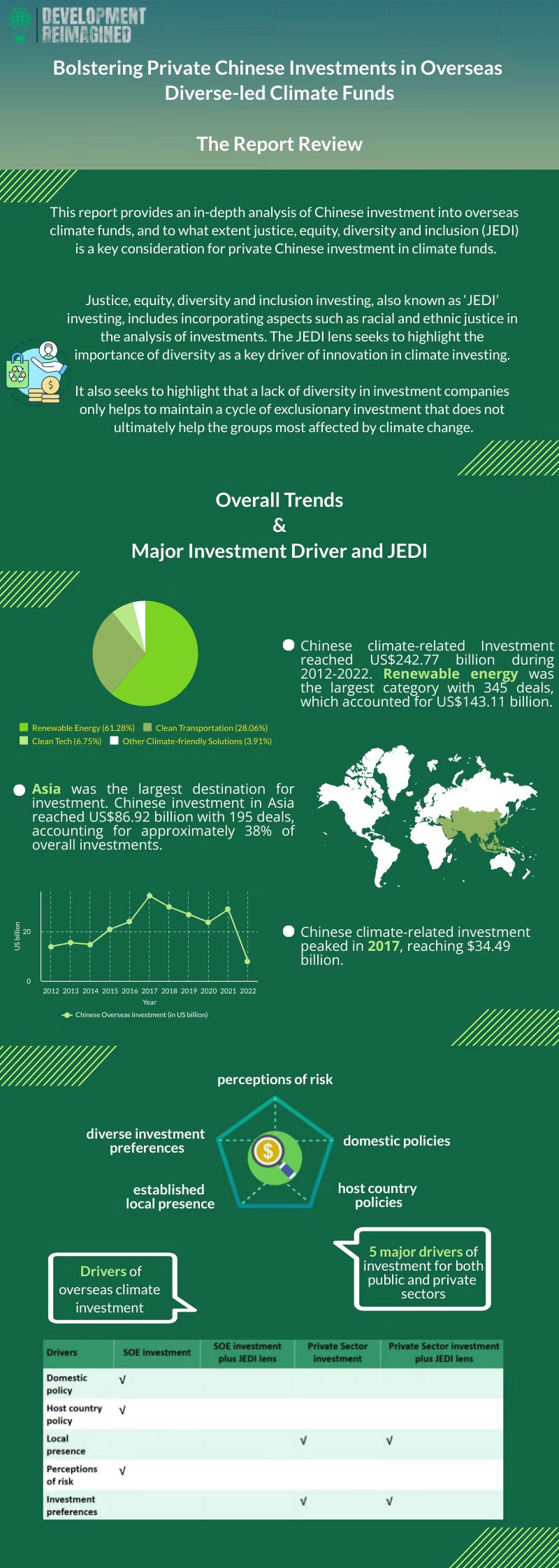

- Despite a range of China-specific and general impediments to international private climate finance flows, Chinese private climate investment is flowing overseas to an increasingly wide range of markets and an increasingly wide range of activities. chinese climate-related investment is estimated to have reached a maximum annual average of US$24.7 billion globally over the ten years up to 2022. This is significant but also limited to some degree by limitations on FDI outflows by the central government.

- Chinese climate-related investment has so far peaked in 2017, reaching US$35 billion. Asia attracted the highest overall amount of investment from Chinese climate investors, accounting for 38% of the value of climate investment, especially renewable energy (especially hydropower). This is particularly because Chinese SOEs are dominant among Chinese investors.

For the private sector, while the approach to overseas investments is more dynamic, Chinese investments in clean technology and other climate-friendly solutions are still mainly directed towards mature markets, particularly the United States, reflecting global climate investment trends. - However, the report includes several case studies demonstrating emerging trends, including increased emphasis on JEDI in investments among certain investors, and these case studies are key examples for all investors on how to integrate a JEDI lens into investment practices.

The report also highlights opportunities to diversity investment destinations, especially towards low-and-middle income countries most severely affected by climate change and its impacts – for instance, by employing the JEDI lens in Chinese government policy and development finance institutions (DFIs).

Finally, the report provides tailored recommended actions for Chinese policy makers, public sector investors and private sector stakeholders to ensure JEDI-informed Chinese investment in overseas climate action.

Looking forward, Development Reimagined plans to work with partners to not only ensure more regularised and consistent global data collection and analysis on investment in overseas climate funds and the intersections between climate finance and JEDI lens, but to also identify opportunities for both SOEs and the private sector to use a JEDI lens to ultimately direct investment to where it is most needed and where it will be most transformational in terms of delivering green growth.

To access and download the full report, please click here.

To talk with our global team of experts and consultants, please contact us at clients@developmentreimagined.com.

April 2023