Economists have a reputation for being sceptical. So much so that there is a book called the Skeptical Economist, and a new book referring to economics as the dismal science. This has a lot to do with our teaching. For instance, we’re taught to be sceptical of the idea that one thing (we call it a “variable”) might directly cause another thing to change. A number of development economists have recently been discussing how a new trend called “complexity” should make us even more sceptical of these relationships.

Now, as you might be able to tell from my previous posts, I usually avoid wearing the sceptics hat. But the other day I came across an article that assumed a linear, causal relationship between two variables. The article was by Todd Moss at the Center for Global Development. He argued that the American organisation that provides investment to developing countries “OPIC” should be able to help low-income countries invest in high-carbon energy – such as coal or diesel powered stations, to help stimulate access to energy in those countries. He argued that the limits that OPIC has on this kind of investment are “strategically counterproductive and morally dubious”.

I, like Todd, certainly feel strongly about access to energy. Around the world, 1.3 billion people have no access to electricity. Over 80% of those people live either in sub-Saharan Africa or in South Asia. Access can vary dramatically within regions – e.g. over 95% of people lack electricity access in Chad and Liberia versus 25% in South Africa. Although problems are currently worse in rural areas than urban areas, even so about 56% of urban dwellers in sub-Saharan Africa lack access to electricity.

Hans Roslings’ latest TED talk cleverly explains why increasing energy access helps reduce poverty. It can expand people’s choices and productivity, particularly for women. It also helps business. A recent survey of manufacturing firms in Nigeria showed 83% of respondents identified electricity as their top problem. In many cases, even when people or firms get access to electricity they still suffer from blackouts (such as experienced recently in India) and lack of affordability. Related problems exist in developed countries. In the UK, around 19% of households were fuel poor in 2010 – meaning they had to spend over 10% of their income on fuel for adequate heating. Energy poverty matters.

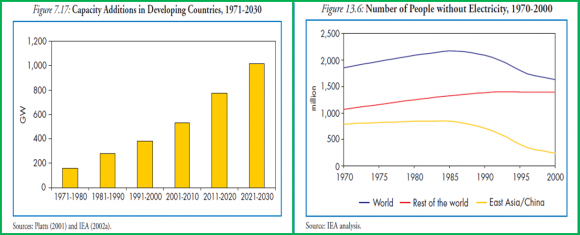

The problem is, from a quick skim of historic data, there is no major reason to expect investment in conventional high-carbon energy to solve the energy access problem. These graphs from the 2003 and 2002 IEA World Economic Outlooks (respectively) illustrate:

Although the dollars invested in the power sector and installed capacity – most of it based on conventional fuels such as coal, gas and oil – have increased strongly since the 1970s, the number of people with access to electricity has increased somewhat, but not a great deal.

Of course, the problem could be population growth, but the data suggests it isn’t. A 2011 study by some global energy experts found no distinguishable relationship between investment in energy infrastructure and the degree of energy poverty once you control for total population. The experts instead suggested the problem was inequality – in many countries, new investment tends to benefit people that already have access. They therefore recommended a five-fold increase in energy sector investment in low-income countries, accompanied by investment in grid extensions, off-grid solutions and renewable energy – rather than the conventional, high-carbon methods used to date.

Added to this, looking ahead, it’s not clear that investing in coal or diesel-fired power will always be sensible for all countries – even if these power sources are abundant domestically. Reports such as the European Report on Development and McKinsey’s Resource Revolution provide evidence that commodity prices are likely to rise and become more volatile in future. A number of economists such as Shalizi and Lecocq think developing countries might regret building infrastructure that locks them into needing to buy coal or oil or relying on their volatile revenues. While there isn’t much evidence on this yet, it’s probably sensible for most countries to aim for a diversified energy sector.

These are the reasons why I was sceptical when I read Todd Moss’s article calling for OPIC to invest in high-carbon energy. It’s also why the UK supports the UN Secretary General’s Sustainable Energy For All Initiative, and why DFID helps low-income countries invest in diverse sources of energy through vehicles such as the Scaling Up Renewable Energy Program, the Results-based Financing Facility and Green Africa Power. Pushing OPIC and others to look in new directions and help forge a new relationship between investment and energy access might actually be a good thing. And with that, I took off my sceptics hat.

This post also featured on Duncan Green’s blog, strategic adviser for Oxfam GB and author of from ‘Poverty to Power.’ Todd Moss from the Center for Global Development has responded to Hannah Ryder’s critique. Read his thoughts and join the debate.