Who We Are?

COVID-19 has ravaged agricultural sectors across the world, with lockdowns, falling demand, and supply chain issues resulting in many producers unable to export their products. The South African wine market was thought to be no exception. But unexpectedly, Sino-Australian geopolitical tensions have not only offered a lifeline to South African wine producers, but an opportunity to enter the Chinese wine market (with its 52 million customers)!

As this recent article by Marcus Ford from Wines of South Africa highlights, as life returns to normality in China, African wine producers should pursue this opportunity to reap long-term gains. Entering the Chinese market can support the country’s economic development and provide secure job opportunities both within the wine industry and the wider supply chain.

The Pandemic and Geopolitics Have Created New Opportunities For South African Wines in China

Whilst COVID-19 disrupted trade flows across the globe and pushed industries into financial trouble, the South African wine sector has, somewhat remarkably, been spared. This is largely due to wine exports to China soaring by 50% after Beijing enforced a 212% tariff on Australian wines after escalating geopolitical tensions.

The question we’ve been tackling at Wines of South Africa, is how can South African wine producers use this opportunity to gain a firmer foothold in the Chinese wine market?

The ban on alcohol sales during South Africa’s nationwide lockdown, along with the government shutting its borders to trade, coupled with the loss of wine tourists, resulted in a domestic surplus of around 400 million bottles of wine. Such circumstances had the potential to devastate the industry which is crucial to the South African economy. In 2019, the wine industry contributed 1.1% of GDP ($3.69 billion) as well as providing 269,096 jobs (accounting for 1.6% of national employment) and $1.28 billion in household incomes. Wine tourism also contributed $1.81 million and 36,406 employment opportunities.

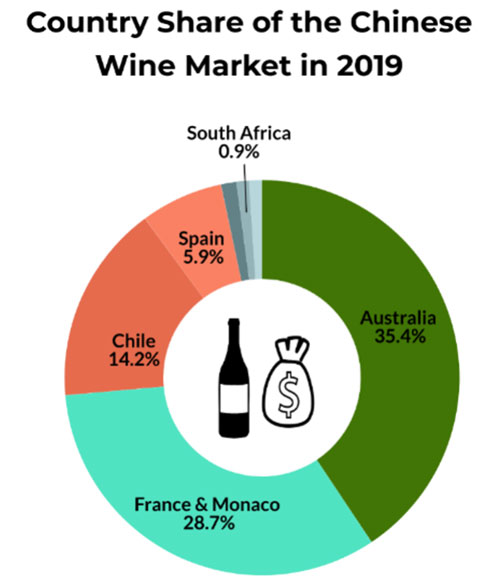

In 2019, South Africa only captured 0.9% of the Chinese wine market share, a tiny amount compared to the top three countries: Australia (35.4%), France & Monaco (28.7%), and Chile (14.2%). Comparatively, China is South Africa’s 4th top destination for wine exports accounting for 4% of its total wine exports.

Tariffs imposed on Australia resulted in a 95% decline in Australian wine exports to China in December 2020 compared to the same period in 2019, thus creating an opportunity for South African producers. On the other hand, however, this also demonstrates the risks of the market when political clashes emerge.

How Did China Become One of the Most Important Markets for Wine?

Understanding the boom in Chinese wine demand requires a brief history lesson. Wine was first sought after in China from 1997 following the publication of the ‘The French Wine Paradox’, which emphasized that red wine reduced the probability of heart disease, and thus the idea of wine being part of a healthy lifestyle took hold. As the Chinese hospitality sector flourished, so has the demand for wine. Wine has become increasingly associated as part of business entertainment and a banquet essential, as well as a luxury for the wealthy.

Chinese domestic wine production has also grown since the 2000s. However, the quality has not kept up with those of imported origins, with consumers beginning to understand the difference regarding wine quality.

This Brings Us to Today, a Window of Opportunity for South African Wines

Recently, the wine market has begun to mature, with consumers becoming more engaged in wine, especially as education programs and digital channels have made information on high-quality, international wines more widely available. According to Wine Australia, there are an estimated 52 million customers in China for imported wine, which is almost double the size compared to seven years ago.

Despite the recent increase in South African wine exports, numerous challenges to entering the Chinese market exist. Importantly, overall demand for wine in China has declined due to COVID-19, with imports down by around 30%, due to the lack of occasions for wine consumption as large gatherings and celebrations were ceased.

Other obstacles exporters must navigate include transport logistics, foreign regulations, procedures and legal requirements, alongside general cultural and language differences. As such, producers must be strategic and ensure they pick the right partners when exporting.

Only a handful of platforms exist for supporting South African wine brands entering the Chinese market. For instance, Africa Reimagined, a Beijing-based trade consultancy, assists African brands, including South African wines, in navigating the Chinese market. To support the growth of exports, Wines of South Africa provides in-depth knowledge of the Chinese market, supplemented with guidance, market research, and distribution partnerships. For example, we published a comprehensive Wine Export Guide, which provides an overview of the typical wine export procedure, alongside providing detailed methods to overcome market-entry challenges. We also work with the Cape Export Network, an online portal that matches distributors and importers with South African exporters.

But What More Is Needed to Support the Growth of South African Wine Exports?

To understand how South Africa can increase its exports, we must look at the methods of other top wine exporters. For instance, China has established Free Trade Agreements with import destinations such as Australia, Chile, and New Zealand, which brought duties down from 14% to zero from 2012-2019. If South Africa could establish a similar agreement on its wines it would help our producers overcome a major cost barrier and support overall export promotion.

Second, promoting the exposure of South African wines both online and offline is key. Chinese consumers use e-commerce platforms to purchase and research wines with 49% of wine consumers from China’s urban upper-middle-class purchasing wine through e-commerce. Harnessing the power of e-commerce platforms as the Chinese middle-class continues to expand can promote our products and further our sales. Additionally, increasing South African wines on Chinese supermarket shelves will elevate the reputation of our wines.

Deepening wine exportation is an effective way for China-South Africa agriculture cooperation compared to other cooperation methods. This is because South African wine producers have considerable experience in exporting their products worldwide, exporting almost 50% of all wine produced in 2018. In 2020, the UK, Germany and the Netherlands ranked as the top three export destinations, each experiencing a 23%, 4%, and 17% export growth, respectively. As the industry is already significantly developed, it does not need extensive development cooperation for it be viable but instead requires institutional support from government cooperation.

2021 Provides a Crucial Chance for South African Wine Producers

Wine is viewed as part of a healthy lifestyle and we forecast this will have a positive impact on increasing wine sales post-COVID. Indeed, we have already begun to see wine sales increasing as China’s economy and consumption are bouncing back fast. China’s GDP is forecast to grow at a minimum of 6% per year – every percentage point of growth brings new consumers which South African brands can capitalize on. We must use this time to establish a secure foothold in the market for future gains.

Expanding our wine exports will generate an array of social and economic benefits for future livelihood improvements across South Africa. Currently, South Africa has the third-highest unemployment rate in Africa, and by the end of 2020, 32.5% of the population was unemployed – a 4% increase from pre-pandemic levels. Youth unemployment is especially high, with a rate of 63% for those aged between 15-24. The pandemic resulted in a further 3 million jobs lost, mainly impacting those employed in the informal sector. High unemployment rates have therefore resulted in limited progress in poverty reduction. Indeed, whilst poverty has fallen from 71% of the population in 1996, it still encumbers 57% of the population as of 2014. Currently, the World Bank estimates that COVID will lead to 2 million more people falling into poverty (living under USD5.50 per day).

Moreover, labor conditions in the South African wine industry have remained poor despite the industry’s growth. Low wages, coupled with seasonal working contracts, have left workers vulnerable to international market volatility, with over 21,000 jobs lost in the industry by October 2020 due to the pandemic.

Considering this, developing a foothold in the growing Chinese consumer market can provide our exports long-term opportunities from increasing demand. As such, this will stimulate additional direct jobs in wine agricultural production, alongside indirect jobs, such as in logistic and transport services, to meet export demand. As South African brands become more reputable, this will likely generate spill-over effects in wine tourism, therefore providing further employment opportunities in the service sector. The provision of jobs and incomes is critical for empowering people to lift themselves out of poverty.

Further, creating a sustainable long-term footprint for wine exports can support the revitalization of the South African economy in its post-COVID recovery. Our GDP growth dropped sharply to -8% in 2020. Whilst we are forecasted to have a healthy 3% GDP growth in 2021, additional growth is an essential factor for developing our economy and driving poverty reduction, alongside enhancing our ability to meet the Sustainable Development Goals in 2030.

The Pandemic, Coupled With Sino-Australian Tensions, Provides an Opportunity to Revitalize South African Wine Exports to China.

But we need to think long-term. Whilst in the short term the demand for wine is still recovering, the long-term payoffs of entering the market, whilst there is a gap, will bring phenomenal gains for the domestic industry back in South Africa. This is not limited to South Africa, and other wine-producing African countries should also seek to take advantage of this market opening. Put simply, this is an opportunity that African wine producers should not miss.

Marcus Ford is the Asia Market Manager at Wines of South Africa, based in Shanghai.

This article was originally published on The China-Africa Project

April 2021