Whether you see it as taking place at the beginning of the calendar year or at the end of the Chinese year, the now annual visit by the Chinese Foreign Minister to the African continent is a remarkable tradition. Alongside its latest Africa policy white paper, it makes China’s foreign policy quite unique compared to its global counterparts. Partly because of this visit, which usually ends up covering 4 to 5 countries within a week, the Chinese leadership can be proud of having made a stunning total of 79 visits to 43 different African countries over the past 10 years. There is no other country that can boast such a record.

But here at Development Reimagined we don’t believe it’s helpful to promote simple one line headlines about China’s engagement with African countries, nor any others for that matter. What is more interesting is getting behind the broad headlines.

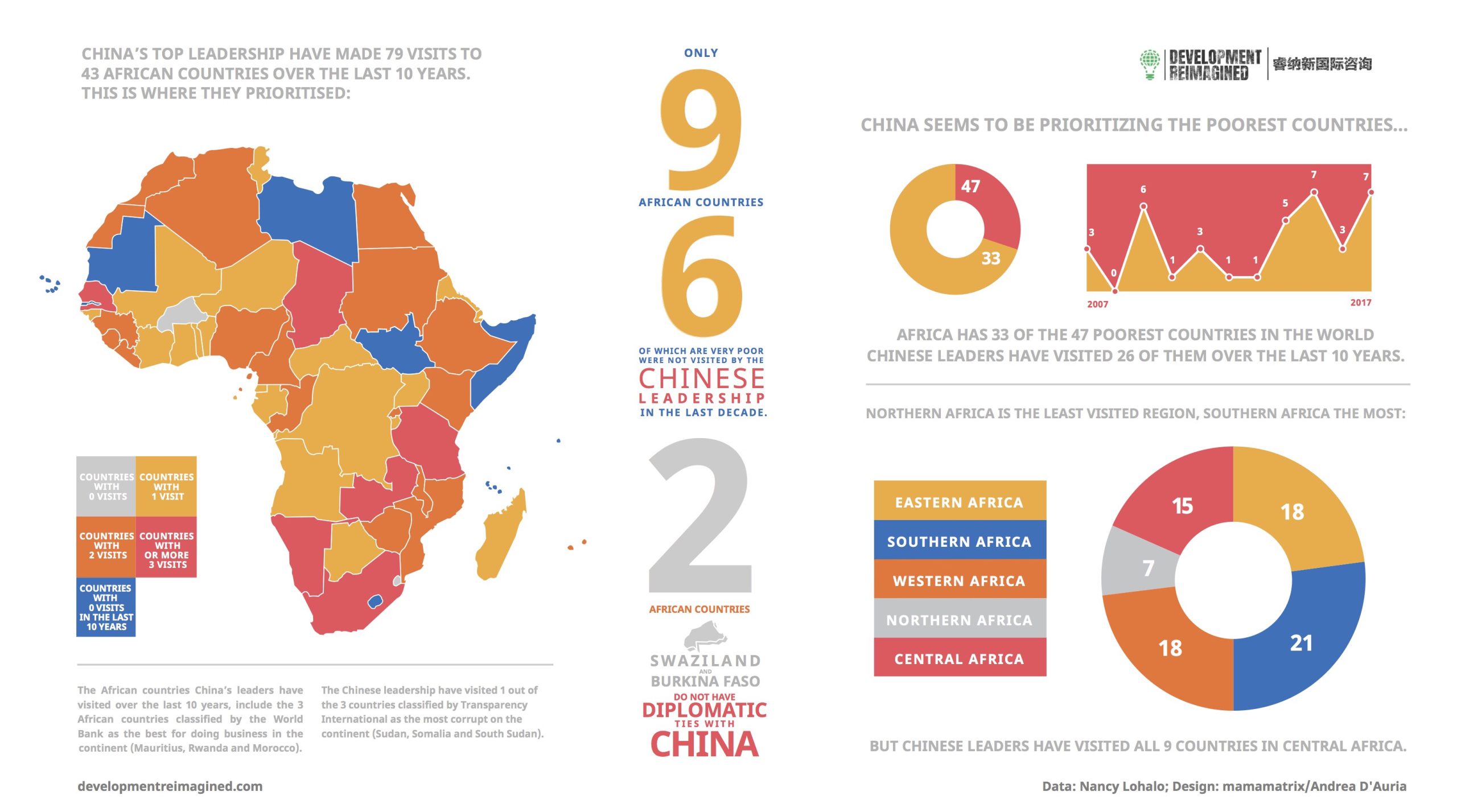

That’s why we’ve produced our first infographic, our first in 2018, exploring the question of exactly where the Chinese leadership have visited within the African continent over the past 10 years. When filing through news reports in Chinese, English and French to gather the data, we wondered what we might discover about Sino-Africa relations. Would the data reveal, for example, media stereotypes that China has prioritised visiting corrupt autocrats? Would it confirm speculation that countries with the largest natural resources are China’s focus? Or, would it reveal that China prioritises the poorest and most vulnerable countries, a narrative which the government is keen to promote?

The answer is – well, none of these. In fact, we found some surprising and not so surprising results. First, South Africa was the top visited country overall, with a total of 7 visits by the Chinese leadership since 2007, including most recently for the 2015 Forum on China Africa Cooperation (FOCAC) Summit. As the most developed – although these days less dynamic – economy on the continent, this made sense to us. South Africa does still have the largest stock of Chinese FDI in Africa. Tanzania and Zambia, with 4 and 3 visits respectively, also made sense, as the Tazara railway was until very recently the largest Chinese-built train line on the continent. But other top hitters surprised us. For instance Chad, typically classified as a fragile state, received high-level visits in 2007, 2011 and 2017. Namibia – rather than its neighbour Angola – was also amongst the top most visited, despite the latter having borrowed the most loans from Chinese financiers than any other African country to date.

The countries the leadership hasn’t visited were also of note. Obviously, the two remaining African countries that have diplomatic ties with Taiwan are non-grata in China’s books. But we found it fascinating that despite all the work China has been doing to support peace in the Horn of Africa, the leadership has not recently visited Somalia or South Sudan, the world’s youngest country, which also has large oil reserves. Several island countries are also waiting for an inaugural high-level visit.

To add more intrigue, China doesn’t (yet) appear to favour the East African region over others, even though on official maps the region appears as the entry point for China’s Belt and Road Initiative (BRI). Nor does China seem to favour richer countries. We found that the leadership have visited 26 of the total 33 African countries that are classified as least developed.

So what does this mean overall for those seeking to understand China’s foreign policy? In one sentence – the data tells us that grand, simplistic narratives are cliched and wrong. We did not compile and share this information to speculate or even spin niceties about China’s foreign policy. Instead, we compiled it in order to be able to look at each country’s individual relationship with China with more clarity going forwards. This is what is most insightful, and crucial. Our CEO has said it many times before, but Africa is not one country. Sharing country-by-country analysis can arm African governments and others with better information about where they sit within China’s priorities, providing new, measurable indicators for them to track progress in that relationship.

High-level visits are just one indicator, and, as our analysis demonstrates, a fairly blunt one at that. We plan over the coming year, as a “public good”, to analyse and share information on other indicators, which may be useful for African and other leaders to use in their Chinese engagement plans. This will be particularly helpful as the 7th Forum on China Africa Cooperation (FOCAC), to be held in September this year, draws closer.

So watch this space, and expect more infographics providing a fresh view on China’s global footprint and other international development trends from us soon. And if you have a burning question for an infographic, do share it with us! We can’t wait to share our findings with you.

January 2018